views

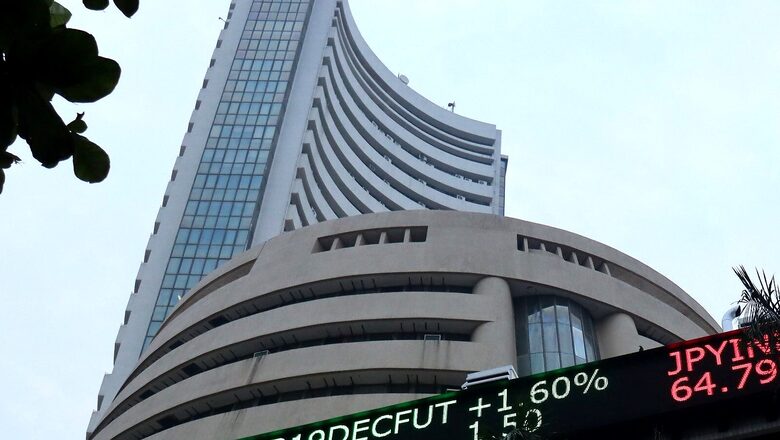

The 30-share BSE-Sensex at close was trading at 59,667.60, down 410.28 points or 0.68 per cent, and the blue-chip Nifty was down 106.50 points or 0.60 per cent and was trading at 17,748.60. About 1463 shares have advanced, 1715 shares declined, and 164 shares are unchanged.

The market ended on a flat note triggered by the profit booking on September 28 but recovered from the day’s low amid buying seen in the metal, power and oil & gas stocks. .”Highly volatile trade witnessed today with significant swings on either side led by the IT & Oil & Gas Index. The PSE Index put up a stellar show today rising over 3% with power stocks making a smart up move. Despite the smart pullback from the lows of the day, declines were higher than advances in the broader market,” S Ranganathan, Head of Research at LKP securities

On NSE, Bharti Airtel, Tech Mahindra, Bajaj Finance, Divis Labs and Bajaj Finserv were among major losers on the Nifty, while gainers were Power Grid Corp, Coal India, NTPC, IOC and BPCL. BSE midcap and smallcap indices ended lower with each down over 0.5 percent. On the sectoral front, the IT and realty indices fell 2-3 per cent, while power, oil & gas and metal indices ended in the green. On NSE, 18 shares advanced while 32 shared declined keeping the market breadth negative.

“Our domestic markets opened flat to negative as US stocks ended mostly lower, weighed down by weakness in tech, while government bond yields rose to the highest level in nearly three months after durable goods orders topped forecasts. Nasdaq Composite slipped half percent while Dow Jones Index gained 0.2%. The 10-year US Treasury yield climbed 3 basis points to 1.49%, the highest since June. Oil held steady after a five-day surge on signs that demand is running ahead of supply, depleting inventories amid a global energy crunch,” Binod Modi, head strategy at Reliance Securities said.

On BSE, BHEL, IFCI, IDBI were among the top gainers while EIHotel, Oberoi Realty, Metropolis, KPR Mill were among the laggards. On BSE, 20 shares declined and 10 shares advances making the market breadth negative.

“Following negative global cues and profit booking in IT and realty sectors, the domestic market hit rough weather, however, it witnessed a rebound towards the closing. Rise in US bond yield and crude oil price along with the Chinese crisis acted as key headwinds to the ongoing rally in the global market. Amid broad-based selling in the domestic market, public sector, energy and metal stocks traded higher,” Vinod Nair, head of Research at Geojit Financial Services said.

In early trade, the benchmark indices opened in the green, the 30-share BSE Sensex was at 60,025.66, down 52.22 points, down 0.09 per cent. The broader NSE Nifty50 was at 17,846, down 8.45 points, 0.05 per cent. The market opened flat, taking mixed cues from the global market. Asian Stock markets tumbled factoring in the uncertainty induced by Evergrande’s crisis that is still hovering over the global markets. The MSCI’s broadest index of Asia-Pacific shares outside Japan was 0.13 per cent lower on Tuesday, following a mixed session on Wall Street. In early trade Tuesday, Australia’s benchmark S&P/ASX200 index was down nearly 1 per cent, while Japan’s Nikkei was off 0.6 per cent. Hong Kong’s Hang Seng Index gained 0.44 per cent.

Read all the Latest News , Breaking News and IPL 2022 Live Updates here.

Comments

0 comment