views

Calculating Interest Rates

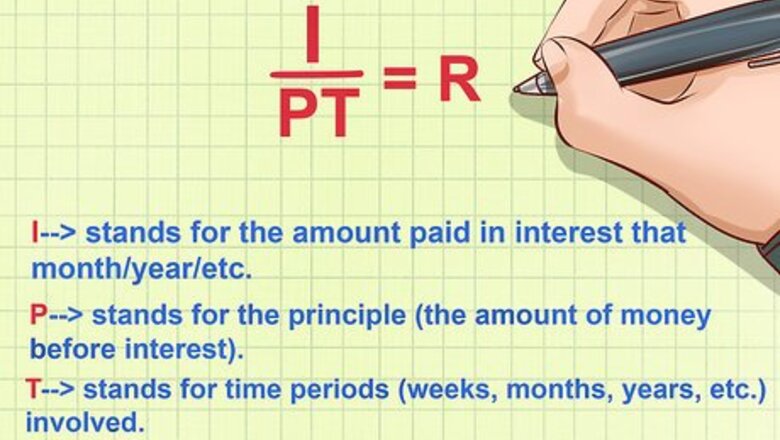

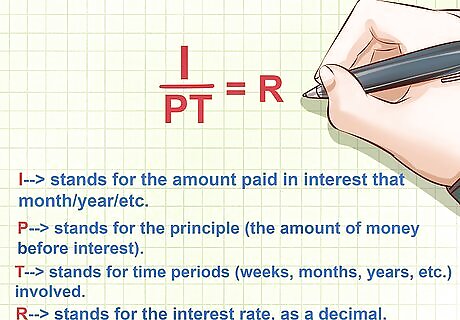

Plug your numbers into the interest formula I P T = R {\displaystyle {\frac {I}{PT}}=R} {\frac {I}{PT}}=R to get your rate. Once you know the basics of this equation, the math is easy. Just fill in the numbers for your loan or savings account after paying/receiving interest. This simple equation can be used to find your basic interest rate. I stands for the amount paid in interest that month/year/etc. P stands for the principle (the amount of money before interest). T stands for time periods (weeks, months, years, etc.) involved. R stands for the interest rate, as a decimal.

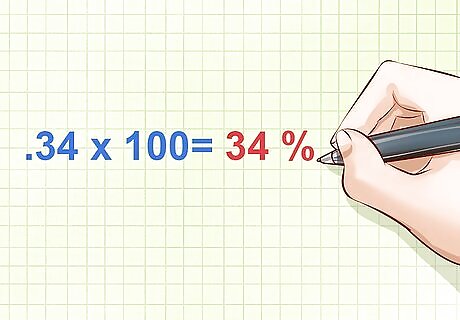

Convert the interest rate to a percentage by multiplying it by 100. A decimal like .34 doesn't mean much when figuring out your interest. Multiply by 100 to get a percentage. This is the percentage of every bill account of principle that is reflected in interest. So, if you got .34 as your rate before, you'd be paying 34% interest ( .34 ∗ 100 = 34 % {\displaystyle .34*100=34\%} .34*100=34\%)

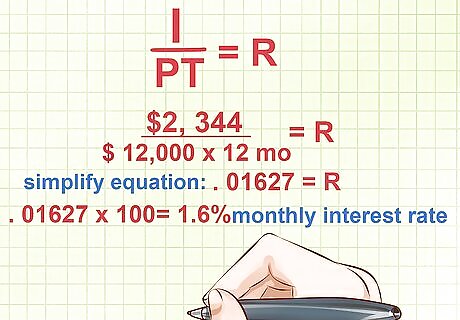

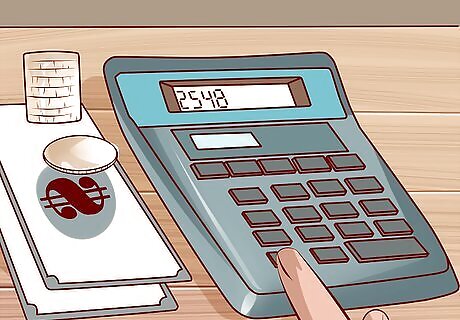

Refer to your most recent statement to fill in the interest equation. You should easily be able to find interest paid, the time period (when the bill/statement is from) and principle. For example, say you paid $2,344 in interest on a $12,000 loan last year. You want to know what your monthly interest rate was. To get it, you could input: Interest equation: I P T = R {\displaystyle {\frac {I}{PT}}=R} {\frac {I}{PT}}=R Plug in numbers: $ 2 , 344 $ 12 , 000 ∗ 12 m o = {\displaystyle {\frac {\$2,344}{\$12,000*12mo}}=} {\frac {\$2,344}{\$12,000*12mo}}= Interest Rate Simplify equation: .01627 = {\displaystyle .01627=} .01627= Interest Rate Multiply by 100 to get the final percentage: .01627 ∗ 100 = {\displaystyle .01627*100=} .01627*100=1.6% monthly interest rate.

Make sure that your time and your rate are on the same scale. Say you're trying to figure out your monthly interest rate on a loan after one year. If you put "1" in for T, as in "one year," your final interest rate will be the interest rate per year. If you want monthly, you need to use the correct amount of time elapsed. In this case, you'd aim for 12 months. The time should be the same amount of time as the interest paid. If you're calculating a year's worth of monthly interest payments, for example, then you've made 12 payments. Make sure you check when your interest is calculated -- monthly, yearly, weekly, etc.-- with your bank.

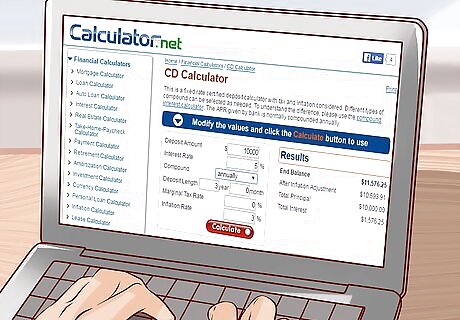

Use online calculators to find rates for complex loans, like mortgages. The interest rate for loans must be readily available when you sign up for the loan or credit card. But tricky terms like APR ("annual percentage rate," ie. "interest") and fluctuating rates may make it impossible to determine what a certain rate even means. These fluctuating rates are almost impossible to determine by hand, but free calculators online can help you find the specifics for difficult loans. Sites like Bankrate.com and CalculatorSoup are unaffiliated and trustworthy. Search online for "Your Type of Loan + Interest + Calculator." For example, find "mortgage interest calculator," "CD interest calculator" or "variable APR interest calculator."

Understanding Your Interest Rates

Talk to your bankers to negotiate a lower interest rate. Getting a lower interest rate is usually just a matter of negotiating. To be successful, all you have to do is come prepared. Know how much money you want, how much interest you'd like to pay, and what rate is going to be too high for you to make a deal before walking in or calling up. Financially stable people with decent (650+) credit scores have the best chance to negotiate rates. Call up your credit card company and let them know that you've found better rates on other cards. If you're a regular customer who pays on time, they will likely try to keep your business. Talk to your banker about the lowest possible rate they can give. Research other options so you can point to other offers. Be wary of variable APR or interest -- it may look appealing at first, but these "deals" often turn into exorbitantly high interest rates after 1-2 years.

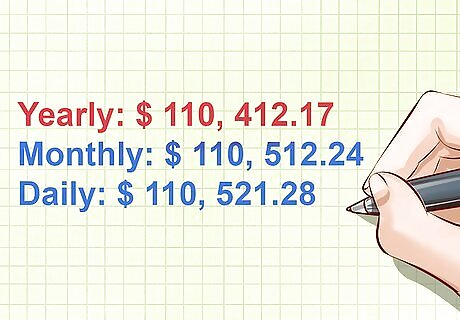

Choose a less-frequent accrual rate to pay less in interest. The accrual rate determines when interest is added to principal. So, if it is really high (such as daily) it means that whatever interest is unpaid at the end of the day gets added to principle. This means the next month's interest payment will be even higher since you have a higher principle. For example, note how a $100,000 loan with a 4% interest rate is compounded three different ways: Yearly: $110,412.17 Monthly: $110,512.24 Daily: $110,521.28

Pay more than your interest whenever possible, no matter the interest rate. Remember that interest is taken as a percentage of principle. Simply said -- the more you owe, the more money you pay in interest. If you can pay off some of the principle every month along with the interest, you may not lower your rate. But you will definitely lower your payments.

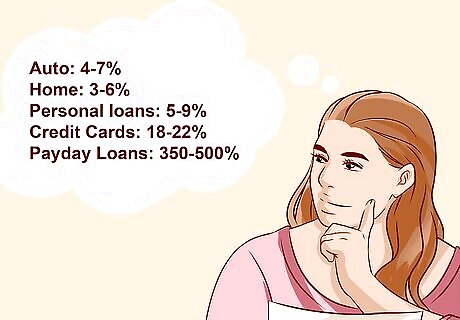

Monitor common interest rates before getting a loan. Interest can be thought of as the cost of borrowing money. Either you pay someone for it, or your bank pays you to "borrow" the money in a savings account. Either way, you should know the rates before signing any paperwork. Auto: 4-7% Home: 3-6% Personal Loans: 5-9% Credit Cards: 18-22% Payday Loans: 350-500% .

Know the interest rates on any investments to money wisely. The safer an account is, like a savings account, CD, or bond, the less money it usually returns in interest. That said, this sort of guaranteed, but slow growth, can be powerful when saving for retirement. Other accounts with higher interest rates will make you more money, but with more associated risk or stipulations attached. Savings Accounts: 1-2% CD 1-2% US Bonds (over 30 years): 3-4% 401k & IRA: 6-10%

Comments

0 comment