views

Finding Out If Money Is Owed

Check with the DMV. If you live in the United States, you can check the status of a car's lien by going to your state's DMV website. You will need to know the vehicle's make, model, and vehicle identification number (VIN), which can all be found on the vehicle's registration paperwork. Though the process may vary somewhat by state, in general an inquiry will follow the same procedure. The DMV will be able to tell you the last date that a title was processed in that state, how many liens (if any) exist on the vehicle, and the name and address of each lien holder. Provide your contact information in the online form through the DMV's website. Fill in all the necessary information for the DMV to identify the vehicle. This will typically include the make, model and year of the vehicle, as well as the VIN. Save the form as a PDF or image file. Attach the form in an email and send it to the email address listed on the DMV website.

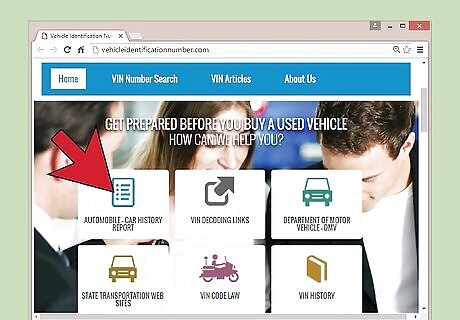

Search online. Many websites, including VehicleIdentificationNumber.com and Carfax, allow you to search for lien information, using the VIN and the vehicle's make and model. Some of these websites are free, while others charge a fee.

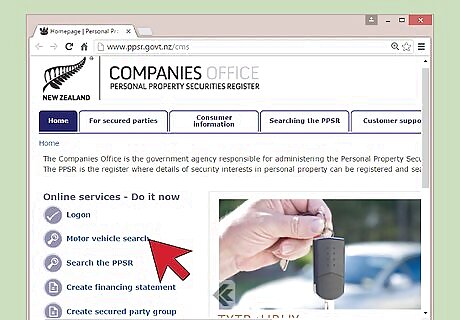

Check with the Personal Property Securities Register. Some countries have a government-run Personal Property Securities Register, or a similar registry in place, in which security interests held in personal property (in this case, automobiles) are cataloged online and can be searched for by interested parties. If you live in a place that has such a registry, you can search online to find out whether or not the car you're buying has money owed on it. Buyers in Australia and New Zealand can go to http://www.ppsr.govt.nz/cms and click "search." Buyers can also have search results texted to a mobile phone for a $3 service fee.

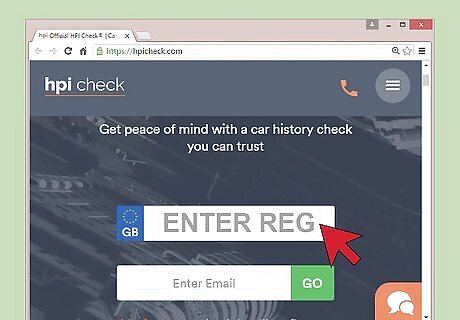

Run an HPI Check. HPI is a company that checks vehicle registrations to verify the histories of used cars. HPI Checks can tell potential buyers if a car has outstanding finance owed on it, as well as whether the vehicle is stolen or has altered mileage. HPI Checks are not free, but can provide peace of mind when it comes to buying a used vehicle.

Ask to see the title or certificate of registration. In some countries, a car owner must show potential buyers a copy of an official certificate of registration, which can only be had if there are no debts owed on the car. In other countries, the automobile's title will reflect that the bank has liens on the vehicle, indicating that the seller has outstanding loans with a financial institution.

Having the Debt Paid

Ask the seller to pay. If you're interested in buying a used car with finances owed, you may want to first insist that the seller pays off his debt before you give him any money. You may want to suggest that the seller take out a personal loan to cover the costs, in order to secure the title before you buy it from him. If you insist that the seller pays off his loans before you buy the vehicle, make sure you get a signed, written proof of payment from the seller's bank or financing company. If you can, accompany the seller to the bank or financial institution so that you can oversee the process and know for certain that the vehicle's loans have been paid in full. If you cannot get something in writing from the bank verifying that the loans were paid in full, you may want to run another search through PPSR or HPI, if those options are available where you will be purchasing the vehicle. This will allow you to verify that the loans have been settled.

Renegotiate the price. If you're still interested in purchasing the vehicle, try to renegotiate the price you would pay to the seller, after factoring in how much he still owes on the vehicle's loans. Subtract the amount that the seller owes to the bank from the price you initially thought was a reasonable sales price for the vehicle. Offer to pay the seller that amount, after you've paid off the remainder of the seller's loan to the bank or financial institution who has a lien on the vehicle. Have the seller send a dated payout quote directly to you. Once you've paid off the loan, and given any remaining money to the seller after agreeing on a price, you can have the title transferred to your name.

Set up an escrow account. If you worry about the seller not holding his end of the agreement to pay off his car loans, you can always set up an escrow account. This would hold your money for a stipulated period of time, during which the seller must pay off his loans and transfer the title to you in order to receive your money. In the United States, the Department of Motor Vehicles recommends using PaySAFE Escrow. Set up an account. Create a transaction, and have the seller agree to the terms and conditions. Deposit your money. PaySAFE will not release the money to the seller until the loans have been settled and the title is ready to change hands.

Ask a dealer to broker the sale. By getting a dealership involved, you ensure that there will be a paper trail that proves all payments were made and that ownership is legal. You may have to pay more, as the dealer will want to make a profit by buying the car from the seller and in turn selling it to you, but you will have peace of mind with your purchase. Expect this to be a costlier option, as the dealer will want to make some money from the sale. You could ask the seller to pay the dealer out of his or her profits, so that you do not end up having to pay more for the car.

Comments

0 comment