views

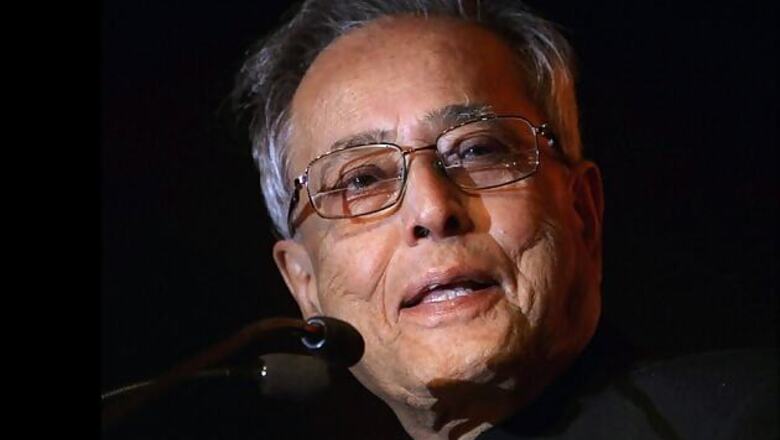

New Delhi: Finance Minister Pranab Mukherjee has been ranked fifth in the list of top forces that effectively deal with disputes and other issues concerning transfer pricing, prepared by UK-based newsletter TPWeek.

Besides Mukherjee, the other leading forces were Organisation for Economic Cooperation and Development (OECD), PricewaterhouseCoopers (PwC), ActionAid and Taskforce on Financial Integrity and Economic Development, revealed the poll conducted by TPWeek.

Around 700 readers comprising tax directors, transfer pricing advisers, non-governmental organisations among others chose the five leading forces in global transfer pricing.

Transfer pricing deals with the technique, wherein parent companies sell goods and services to subsidiaries in other countries to minimise tax liability.

"The Indian Minister of Finance was nominated for his power to implement an APA (Advance Pricing Agreement) programme in India. This is a long-awaited development for India tax payers and the new option for certainty will go some way to alleviating taxpayers' dispute in the country and may encourage more foreign direct investment," TPWeek said.

According to the 2012-13 Budget memorandum, Advance Pricing Agreement (APA) is an agreement between a taxpayer and a taxing authority on an appropriate transfer pricing methodology for a set of transactions over a fixed period of time in future.

The APAs offer better assurance on transfer pricing methods and are conducive in providing certainty and unanimity of approach.

"The Minister's power to influence India's standing in global economics through the tax system influenced a number of voters," the newsletter said.

The law requires that goods and services should be sold to subsidiary companies at arm's length price, the price at which goods are traded between unconnected companies.

TPWeek said that Mukherjee also has the power to implement the inter-quartile range and the acceptance of multiple-year data, bringing Indian transfer pricing further in line with global best practice.

Experts said that the APAs offer better assurance on transfer pricing methods and are conducive in providing certainty and unanimity of approach.

Others who have been nominated by the TPWeek include OECD for their project on intangible assets, PwC for its report on transfer pricing in developing countries.

Besides, ActionAid was nominated for its report on drinks company SAB Miller, entitled Calling Time: Why SAB Miller should stop dodging taxes in Africa.

The NGO -- The Taskforce on Financial Integrity and Economic Development was nominated for its campaigns for improved transparency and accountability in the global financial system.

Comments

0 comment