views

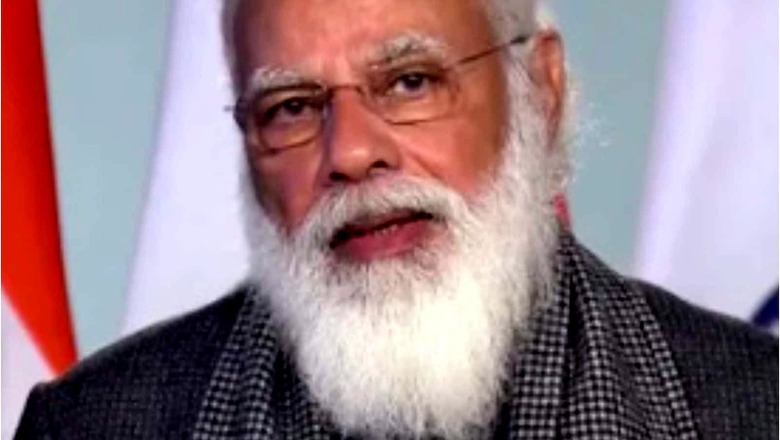

Prime Minister Narendra Modi will launch two important customer-centric initiatives by the Reserve Bank of India — the Retail Direct scheme and the Integrated Ombudsman scheme on Friday, November 12. The much-awaited RBI Retail Direct scheme would allow the retail investors to directly invest in securities issued by the central and state government. The users can open and maintain their government securities accounts online with the RBI for free, the central bank said.

The scheme offers a portal to invest in central government securities, treasury bills, state development loans and Sovereign Gold Bonds scheme. The Reserve Bank of India earlier said investors will have access to bidding in primary auctions as well as the central bank’s trading platform for government securities called Negotiated Dealing System-Order Matching Segment, or NDS-OM.

Termed as “major structural reform” by RBI governor Shaktikanta Das, this scheme will help customers to invest in G-secs which carry almost zero default or credit risk. The move was intended at improving ease of access by retail investors through online access to the government securities market – both primary and secondary — along with the facility to open their gilt securities account (‘Retail Direct’) with the RBI.

“The retail direct scheme offers a safe, simple and direct channel for investment in government securities,” the RBI said, adding, “The scheme places India in a list of a select few countries offering such a facility.”

“The retail direct scheme offered by RBI is a good opportunity for retail investors to invest in government securities, sovereign bonds etc. It is the first time in India when retail investors will have an option of simple and direct channel for investment in government securities,” said Ravi Singh, head of research & vice president, ShareIndia.

“We advice the retail investors must diversify their investment and go for this advantage to have a better and safe return,” Singh added.

Meanwhile, the Integrated Ombudsman Scheme aimed to further improve the grievance redress mechanism for resolving customer complaints against entities regulated by the central bank. The scheme would be based on “One Nation-One Ombudsman” with one portal, one e-mail address and one postal address for the customers to lodge their complaints. Under this new initiative, there will be a single point of reference for the customers to file their complaints, submit documents, track the status of their complaints. The customers would also be able to provide feedback based on their experience of using the portal, the central bank said. The Reserve Bank of India will provide a multi-lingual toll-free phone number for all the relevant information on grievance redress. It will also provide assistance for filing complaints.

“RBI’s recently announced Integrated Ombudsman Scheme is expected to be a game changer in terms of amplifying transparency among customers. Owing to the increasing number of complaints from consumers against banks and digital platforms, the ‘One Nation One Grievance Redressal’ scheme simplifies the process of streamlining inconsistencies in digital payments,” said Maynak Goyal, chief executive officer and founder of moneyHOP.

“Additionally, virtual investors can now directly handle consumers’ complaints under a dedicated portal, thereby speeding up the process. Transparency is the key to longstanding relationships in the fintech realm. With the Ombudsman Scheme coming into effect, the trust quotient between banks and fintech players and their customers will surely strengthen,” he further added.

Read all the Latest Business News here

Comments

0 comment