views

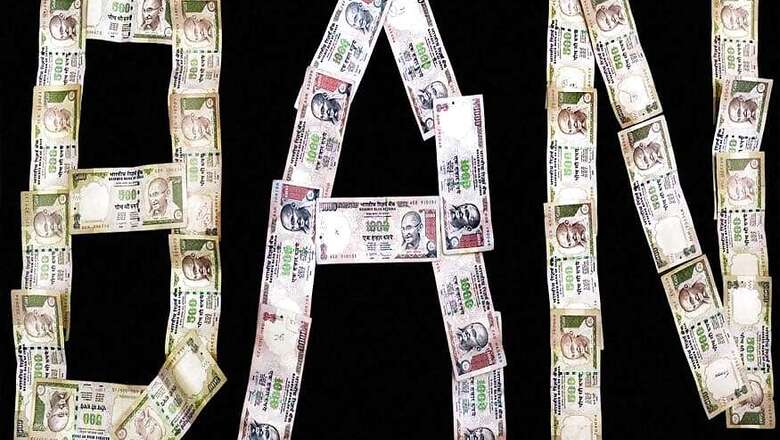

Mumbai: SBI Research has attributed the lower outward remittances and massive jump in travel receipts, which bumped up the December quarter CAD, to the note ban impact that dominated the review period.

The upward revision in services exports is one of the main reasons in containing CAD, says the report.

The rise in services export is mainly due to a rise in net travel balances, which grew by a massive 146 per cent to USD 2,476 million in Q3, when the demonetisation was announced, it said.

The increase in net travel balances can be largely attributed to 73 per cent quarter-on-quarter growth in personal travel, it further said.

"We believe, people travelling to the country during this time may have bought in more dollars/old currencies, thereby getting reflected in travel receipts during this period," it said.

On demonetisation causing lower outward remittances, the report said outflows through the liberalised remittance scheme (LRS) that was showing a steep jump in the beginning of 2016 and possibly leading to a decline in domestic deposits, is now tapering off sharply.

Interestingly, in the note ban quarter, the growth rate of inward remittance slipped to 56 per cent from a high of 342 per cent in the preceding quarter.

"Now, whether this is due to increased apprehension on the part of public regarding tighter norms for unaccounted money or something else is entirely a matter of debate and conjecture," the report said.

"But the fact is, this may have resulted in lower remittances abroad and possibly an increase in domestic deposits," it said.

The CAD stood at USD 7.9 billion (1.4 per cent of GDP) in the third quarter of FY17, up than USD 3.4 billion (0.6 per cent of GDP) in the preceding quarter.

But in percentage terms, it was stagnant at 1.4 per cent in the year ago period, and was up by USD 800 million in absolute terms.

The less-than expected widening of CAD has burnished the rupee's strength after an increase in the US interest rates, the report said adding that "the strong CAD data can support the rupee in the short-term."

Comments

0 comment