views

New Delhi: Does your bank pass book make shivers pass up and down your spine? Shape up all your accounts – savings, recurring and fixed deposits to lop down mistakes, add zing to investments and hear the welcome rustle of crisp currency notes.

That way, you won't balk, when you look at bank passbook. Here are tips to make bank balance big, in looks and books:

Put shine in savings accountA savings bank account is, generally, thought of as a cupboard, where money is put in and taken out. But, with masterly strokes, you can actually mint money.

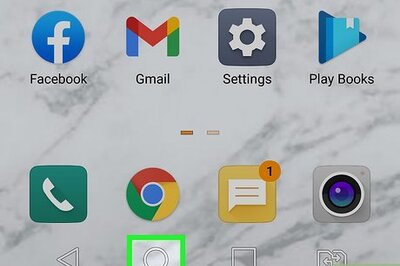

How can one make money earn money? A common mistake is making cash withdrawals, big and small at any time of the month, from bank. It is not advisable to this. Because interest is calculated on minimum balance between 10th and last day of every month, in your savings account. Hence, if there is less money, interest plunges down.

Be prudent, by taking out money in first week or so of month only, deposit surplus earnings before 10th always, keep on adding cheques and any amounts pouring in till 30th or 31st and watch cash bundles balloon, with dollops of interest.

Another hint is never make too many withdrawals, one after another. If a person withdraws money more than four times a week through cheque, ATM, credit card and electronic fund transfers for three months, then he is charged a hefty Rs 50 for every time he takes cash from bank, subsequently.

Keen to grab whopping interest? The savings bank accounts give 3.5 per cent interest after every half-year. Choose banks which are now offering quarterly option. That is, ask the bank to compound your interest every quarter, instead of six months and prosper in a twinkling.

Avoid a bank, which requires a high opening deposit. There are now banks, which require Rs 100 only to open an account. And, yes, there is chequebook facility.

Remember, the minimum balance requirement penalty is attracted when opening deposit is not maintained. If one starts a bank account with say Rs 5,000 or Rs 25,000 sum, the amount has to retained, at all costs. Don't spend more than Rs 1,000 in any case, on just opening an account.

A Family Savings account is another device to stave off minimum balance requirement threat. Combine yours, spouse’s, parents’ accounts and if total is say, Rs 20,000 there is no need to show a minimum balance of Rs 20,000 in your own individual account.

Open no-frills account for expensesOpen a no-frills account, with any amount and the exciting part is that no minimum balance is to be maintained. Dip into it for all your expenses. The savings account is, thus, left untouched and the whole amount there merrily earns interest.

Make recurring deposits robustA recurring deposit, of variable type can be opened. That relieves you of putting a fixed sum every month. One can put in Rs 5, Rs 100 or Rs 500 a month.

An ordinary recurring deposit, where a regular sum is submitted always gives higher interest than a savings account.

For example, an amount of Rs 100 can easily turn into Rs 2,626, if interest is 8 per cent, in two years. A higher sum like Rs 750 reaches a staggering total of Rs 19,698 in same time. The money accumulated over years can be used for child's education, meet unforeseen expenses or even to buy a car!

Contd on Pg2...

PAGE_BREAK

Spruce up fixed depositsHave surplus money or want to make a fast buck? Set your sights on a fixed deposit.

A stores away Rs 20,000 extra in savings account because he has to draw it out some time. Instead, if he puts money in a fixed deposit, for 30 days, there would be more dough, waiting at bank.

Plump for auto renewal facility, to make fixed deposit flourish.

For example, B has a fixed deposit, carrying 8 per cent interest, which matures on March 24, 2005 and the accumulated amount in normal course would be credited to savings account, where the sum, languishing under 3.5 per cent interest rate would yield little return. Instead, if B invokes auto renewal amenity for his fixed deposit for one year, more, there would be no break and he can count a whole lot of money after two years.

Opt for a reinvestment strategy, to multiply fixed deposit amount.

For instance, C holds a fixed deposit for six months. He puts interest, which accrues at end of first quarter, into fixed deposit. C continues with the deposit. Because he earns interest on interest, on cumulative basis, high returns are assured.

Always try to renew a deposit for a lengthy time.

For example, D's fixed deposit, of one year matures on August 13, 2005 and after thinking for some time, he decides to renew it in December 2005. But the smart thing would be to tell bank to renew it with effect from August 2005 itself. The benefit of interest would cover longer time, as it would be treated as a 2-year deposit.

Choose quarterly compounding rests schemes for fixed deposit, where principal and interest are accumulated each quarter and passed on to next quarter, till maturity. Avoid settling for plain interest in every quarter or reduced sum, called discounted value, every month.

A little alertness paysTry to avoid service charges, which nibble away earnings. For example, a bank which collects fees for chequebooks, balance enquiry, cheque status query, demand draft issue, use of phone, fax or modem can be shunned. Collect monthly bank statement from bank, instead of home service, because it may cost Rs 23 and don't settle for cheque pick-ups, as Rs 50 charge is levied, each time.

A multi-city chequebook is handy for amounts spent on issue of demand drafts and charges are fully eliminated. A savings account may also be offering free ATM cards, complimentary international debit card and no-cost branch transactions. Check which fixed deposit, has add-ons like lockers with no rent or credit card fee waiver in first year.

Bounty from bankMake a minute study, before putting your valuable money in bank. For example, where two banks announce fixed deposit schemes of five years and 61 months, with former offering 6 per cent and the other 7 per cent take the second one. By waiting for one month, to allow fixed deposit to mature, you get colossal sum.

All in all, cash grows, withdrawal slows. The big proof is that next time, you can actually manage to bare your teeth – in a smile at the bank manager.

The author, Meenakshi Subramaniam, is a former IRS officer.

Comments

0 comment