views

Determining Your Business Viability

Acquaint yourself with debt collection services. Before you begin seriously considering if you want to start a debt collection agency, acquaint yourself with the industry. This can help you make an informed decision about whether or not this is the right job for you. The debt collection industry in the United States is a huge economic force: every year, agencies collect about $50 billion in total, from which they earn over $10 in commission and fees. The success rate of collection agencies can depend significantly on having know how—from education and professional experience in the industry.

Assess your abilities to collect debts and run a business. Before you begin making plans to start a debt collection agency, you first need to honestly assess your abilities not only to run a business, but also to collect debts. Taking an objective view of your skills can help you decide if debt collection is the right option for you. Having practical experience with credit and collections is a must to run a successful debt collection agency. You may need to get further education in finance, credit, debt collection as well as some practical experience before you can start. This can help your business be more successful.

Think about how being a debt collector will fit into your lifestyle. Knowing whether or not the time, emotional, and physical demands of being a business owner and collection professional fit in with your lifestyle is important if you want to run a successful agency. Consider the following questions to see if being a debt collector is the right choice for you. Are you able to handle the physical demands? Having a collection agency might require you to sit or stand on your feet for long periods of time. You may also need to lift heavy office equipment on occasion. You should be willing to spend at least 10-12 per day and six days a week to develop your business. Are you able to handle the emotional demands? Having to demand payment from another business’s clients can be draining. You may have to ask people with no money or serious medical conditions to pay, or you may have to deal with belligerent people. Think about if being a debt collector fits your personality. Client management is a significant part of the job and if you don’t like working with people, this may not be the right choice for you. Are you able to meet state and federal requirements to be a debt collector? Most states have specific laws on bonding, licensing and trust account requirements for debt collectors.

Examine if debt collection meets your financial needs. Debt collector earn on average about $38,000 per year, including base salary and commissions. This amount can change depending on your clients and if your agency is part of a franchise or independently owned. Only proceed with your plans if the average pay or below meets your financial needs. Remember that you will have to pay taxes and other fees for your business and that annual overhead such as bonding and insurance, payroll, and office supplies.

Establishing Your Debt Collection Agency

Learn debt collection laws. Before you can start your business, it’s important to learn federal and state debt collection laws. These regulate how you can collect debts from individuals and businesses and may affect they type of agency you establish. You’ll need to know about laws such as the Fair Debt Collection Practices Act, The Fair Credit Reporting Act, the Health Insurance Portability and Accountability Act, and the Gramm-Leach-Bliley Act. You’ll also need to know about bankruptcy laws. You may want to consult an attorney on what laws and regulations you need to know to start a debt collection agency. Consider getting additional education on debt collection from professional associations or at a local university to help you understand regulations and running a business.

Write short- and long-term business plans. Write out detailed short- and long- term plans to guide your collection agency. This is important to help develop your business and accommodate for any contingency such as an illness or a lawsuit. It may also be important to show to any local authorities or financers. Be as detailed in your plan as possible, considering every aspect of being a collection agency. List owner and any employees’ responsibilities. Create a working list of services and fees that you can tailor to demand. Finally, make sure to calculate any costs you may have to take on for supplies and payroll.

Create specific plans for collecting debts. Creating a specific plan for how you will collect debts is an integral part of having a successful agency that you can incorporate into your general business plan. These plans can help you think about every aspect of your day-to-day business, but also may help attract clients and legitimize you to banks and other businesses. For example, you’ll need to include information on how you will set up new accounts and monitor activity on current accounts, such as with a computer system that displays information when you call or write a debtor. You should have a client accounting module that can give you information on accounts referred to you by each creditor and the success in recovering accounts. This can help you see what clients are actually generating profit for your agency. You will also need information on how you’re going to store sensitive financial, personal, and in some cases health, data.

Start your business. You need to found a legal entity before you can begin collecting debts. Start your business as a legal entity with the appropriate federal and state authorities. Having the proper licenses, and billing and fee structure, can help show potential clients and financers that you are a serious businessperson. If you have any questions, consult the Small Business Administration, which was set up to help smaller companies. You can also consult the Association for Credit and Collection Professionals at www.acainternational.org. Make sure to register your business with the Internal Revenue Service (IRS) or other tax authorities. You may want to hire a local accountant to help you navigate the financial side of your business, from registering with the IRS to budgeting.

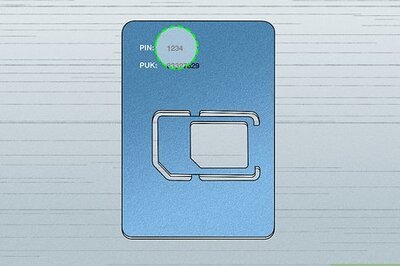

Obtain correct licenses, bonding surety, and insurance. Federal and state laws govern debt collection and you will require specific licenses and insurance to start your agency. Check with local authorities before you start your business and then obtain any licenses, certificates, and insurance required by law to run your collection agency. There are specific laws in the United States and in specific states under which your collection agency will be subject. Regulations vary from state to state. Most states have laws that require debt collectors to have specific licensing and bonding before they can begin business. In addition, most have trust account requirements. Not having the proper licenses, bonding, or trust accountability can open you and your business up to considerable liability. The Small Business Administration can help if you have any questions. You can also consult the Association for Credit and Collection Professionals. Make sure to get insurance that will cover your assets and general liability.

Apply for financing if necessary. Most collection agencies fail because they don’t have sufficient funds. Apply for financing at a local bank for financing to start your business and get you through the first six months. It’s important to have a well-developed business plan to show potential financiers or clients. In addition, having the proper legal entity and licenses can help legitimate you and your business to banks. You’ll want to consider the average collection industry recovery rate of 19.4%. This will help you estimate profit to gross revenue, which you’ll need while applying for financing.

Find a mentor for you and your business. Seek an experienced mentor who understands the debt collection or credit industry. She will help grow your business and guide you through difficult times or situations. This person can offer invaluable advice on everything from fee structuring to dealing with difficult clients or continuing your education as a debt collector.

Set up or rent a space for your business. You will need a designated space from which to run your collection agency. Either setting up a home space or renting a retail space will allow you to start buying supplies and start making profits. If you want a space outside of your home but don’t want an entire office, consider renting a cubicle in a larger retail space. Make sure the space is quiet so that you can conduct business in a professional manner and hear clients when you speak to them.

Purchase equipment, services, and supplies. You should have listed the various equipment, services, and supplies you may need in your business plan. Once you’ve established your company, purchase these items to start collecting debts as quickly as possible. You’ll need designated toll-free phone lines on which clients can easily return your calls. You’ll need to purchase a high-quality computer, plenty of paper for letters, and may want to consider purchasing mail supplies to send out collection notices. Consider purchasing collection-specific hardware and software. You’ll also need high-speed Internet services. Technology can help you more effectively collect debts and retain customers.

Compose collection letters. Informing debtors that you are a collector trying to recover a debt for another company is one of the central elements of a collection agency. Compose a series of collection letters to send debtors that you can send in bulk. This can help you more quickly recover debts and make a profit. Make sure your letters comply with federal and state laws. You must inform clients that they have at least 30 days to respond to your letter or dispute the debt. Include information such as to whom the debt is owed, how a debtor can contact you, and any fees for your services. Review collection letters monthly to ensure they comply with state and federal regulations.

Building Your Business

Decide on fee structure. Set up fee structure for your services. You can collect a commission for the amount of debt recovered or buy bad debt outright and collecting the entire amount. Knowing how much you want to charge in advance can make you appear more professional when you meet with potential clients. If you decide to buy bad debt outright, you will make money based on what you paid for the debt versus how much you recover from the debtor. You may want to set base rates and tailor them according to each client. Be aware the large collection agencies may offer the same services for a lower fee or commission, so consider if and how you want to compete with them. Make sure your fees are commensurate with your experience and success rate.

Install an invoicing and payment system. Once you know your fee structure, install an invoicing and payment system. Consider the types of payment you will accept and how you will write receipts, which will help legitimize your business and make it easier to report income. Make sure to have a separate bank account for your business than you do for personal finances. Likewise, have separate credit lines for your business than you do for yourself. Make sure every aspect of your fees is transparent to clients. Maintaining fair collection practices is vital to your success.

Set up a marketing strategy. You may need to avoid traditional marketing strategies such as media advertising for your collection business because of local laws. Nevertheless, hooking potential customers and keeping your message simple and concise can help attract a wide array clients. You’ll need business cards, letterhead, and may want to consider flyers or brochures. Research other collection agencies to see how they attract customers. You want your brand to be simple, distinctive, and attractive to potential customers. Consider businesses with which you would like to work. Do you want to specialize in medical debts or credit card debts? This may help you identify potential customers and how best to attract them. Small businesses rely heavily on word-of-mouth advertising. Build clientele through referrals and maintaining strong business relationships with your clients.

Recruit clients. Recruit potential clients to start collecting debts. It’s advisable to have enough business to cover you for six months to ensure that you have capital as you grow your agency. You’ll need to present potential clients with your business plan, your resume, and any other information they may need or want to know. Consider writing professional letters to local businesses to help attract clients. Set up meeting with local businesses to discuss the possibility of working together.

Hire staff to assist you. Consider hiring staff to assist your debt collection activities. In the early stages, you may need to be the only person on staff- or you may not yet have the finances to hire staff. If you decide to hire employees, you’ll need to interview the person and make sure they are professional, experienced with credit or debt collection, and can help you grow your business. Any employees may likely need licenses, certificates, and bonding to work as a debt collector. They may also need education on debt collection laws.

Stay informed on debt collection laws, regulations, and trends. Debt collection can be a very lucrative business. In order to be successful, you’ll need to continue your education in the field, including staying on top of changing laws and other trends such as technology developments. This can help you maintain a successful and healthy business and minimize your risk for liability. Read trade publications, attend continuing education, and network with other collection and credit professionals to help you stay current in your skills, services, and trends.

Comments

0 comment