views

Evaluating the Company

Ask to see the company's business plan. If you're going to work for the company, you should have a good understanding of their revenue stream, their expected growth rate, and how they'll be making money. If you have any questions about the company's viability, seek a second opinion from an accountant or other individual who specializes in business finance.

Research the background of the company's founders and leaders. Your equity potentially has more value if the founders and leaders have been successful in the past. If they've had startups in the past, find out what happened to those companies and how they were run. If this is the first startup for all or most of the founders, find out if they have any business advisors or others with experience helping them plan. Keep in mind that the CEO and other board members can boost or sink the company. If the founders have a good reputation and are well liked and respected in the industry, this could go a long way towards helping the company succeed. On the other hand, someone with a bad reputation (or no reputation) could put the company in danger if he or she rubs a powerful industry leader the wrong way. You also should pay close attention to how any of the founders' prior startups ended and what happened to the other employees – especially those in positions similar to yours. Looking at the activity of the founders in other situations can give you a decent idea of what to expect now. For example, if one of the founders sold a previous startup and made off with millions while the employees were left holding worthless stock options, you might question whether he can avoid letting greed get the best of him now at the expense of others who helped build the company.

Check the reputation and experience of the company's investors. It's a positive indicator if professional, well-respected venture capitalists have taken an interest in the company. Venture capital funding suggests that the start-up has enough money to pay its employees and get the operations off the ground.

Ask how much money the company has and how long that will last. The company has offered to pay you, but you need to know how long you can count on receiving cash compensation before difficulties surface. In investor lingo, you want to know how long the company's runway is, based on its burn rate. The burn rate is the amount of money it costs to operate the company on a daily basis. The company's funding should be in line with your vesting schedule. For example, if your stocks don't vest for four years, but the company has enough money to last only six months, you need to find out what their plans are for getting additional investors.

Reviewing Your Offer

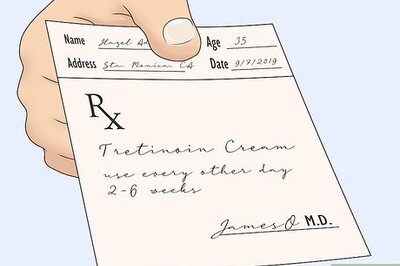

Get the offer in writing. No matter how well you know the founders of the company, you must have the offer in writing so you can properly evaluate the terms of the offer. The company may want to talk to you to work out terms before they put anything in writing, but at some point you should have a written agreement that includes all the terms of your offer. Keep in mind that written agreements are much easier to enforce legally than are oral agreements. If you get the offer in writing, none of the company's managers can later go back on what they offered you or claim they said something different.

Talk to an accountant. If you don't already have an accountant, look for someone with experience in startups and equity compensation, ideally in the same industry as the company from which you received your offer. An accountant will not only be able to analyze your offer and assess the risk you would be taking if you accepted it, but s/he can review the company's business plan and financial projections and offer an opinion on whether those projections are realistic, given the market climate.

Consider consulting an attorney. An attorney can help you understand the legal implications and tax consequences of your deal and review other corporate documents for you. An attorney will inspect all documents and terms related to your offer, looking for anything that might serve to limit your rights or impede your ability to benefit fully from the equity compensation for which you've negotiated. Corporate organizational documents such as articles of incorporation may conflict with or limit your equity. For example, your stock may be restricted such that the company reserves the right to repurchase your stock if your employment is terminated or the company is sold – even if your options are already vested. An attorney will be able to analyze all documents and explain to you how they work together. Keep in mind that you may owe taxes on your stocks or stock options, even if you aren't able to sell them yet.

Evaluate the terms of the offer. Make sure you understand all the lingo or buzzwords being used in your offer and what they mean for you in the short and long term. If you're granted stock, that means you own it outright. After a certain period of time (your vesting period), you can sell it whenever you want and 100 percent of the money is yours. Stock options, on the other hand, are exactly what they sound like – you have the option to buy a certain amount of stock at a certain price (known as the "strike price") after the vesting period. Whether you prefer stock or options will depend on your current financial situation as well as any cash compensation offered. It also depends on how viable you believe the company to be. After all, if the value of the stock goes up, you stand to make a profit. However, if the company is sold or goes bankrupt, you may end up with nothing. Make sure the offer includes details about what happens if a third party makes a substantial investment later on or even buys out the company, and make sure you understand the consequences.

Calculate the value of your equity. Your offer should attach a monetary value to the shares you will acquire in the company. If you're given a specific number of shares rather than a percentage of the company, don't worry too much about other investors diluting those shares. If a third-party investor buys a large number of shares, the percentage of your stake in the company will decrease, but the number of shares you have and their total value will not. For example, if your offer includes stock options, they will have a strike price attached. Using that value, you can determine how much it will cost you to buy those shares. In contrast, the acquisition share price is how much someone else would pay for your shares. The difference between the acquisition share price and the strike price is your equity. If you know the company's valuation from a recent round of funding, you can use that figure to make a reasonable guess at what the acquisition share price would be. Of course, the company's value may increase or decrease over time, so this figure is just a rough estimate.

Compare your compensation to that of peers in your company. Ideally, your equity and cash compensation should be equivalent to similarly situated employees who entered the company at roughly the same time as you. You also can investigate the compensation packages of similar employees in similar companies to see how your offer stacks up with theirs.

Determine whether your vesting schedule makes sense for you. If you're not planning on staying with the company for several years, the schedule may render your equity worthless to you. Your vesting schedule describes when you actually get your stock and how much of it you get. Even though you may have been granted shares of stock, you can't sell those the day you start your job. Rather, you must work for a period of time before you gain control over them. How long you must work at the company before you have full control over your equity is the first part of your vesting schedule. The second part relates to the rate at which you gain control over your shares. For example, if you have an equity grant of 1,000 shares that vest quarterly over four years, and you leave the company after one year of employment, you will have only 250 shares of stock. Particularly if you have stock options, you may be unwilling to stay at the company long enough to see any significant return on your investment. Additionally, your exit clause probably gives you a limited period of time to purchase those options, typically 90 days, or else you forfeit them. If you don't expect to have the money to purchase those options, the schedule probably won't work for you.

Optimizing Your Compensation Package

Present your counter-offer. After reviewing their offer, if you have serious problems with any of the key terms, build a counter-offer that better reflects what it will take to get you on board. When you set out to negotiate your equity compensation, schedule a meeting with the founders or other leaders in the company. Have the meeting face-to-face to discuss your offer rather than exchanging emails or texts. This will make sure everybody's on the same page and save a lot of time going back and forth, so you can close the deal more quickly. Start by explaining your understanding of the terms, and make sure that your understanding matches with what the people who crafted the offer intended to present to you.

Prioritize equity over cash. Since startups typically are strapped for cash, you won't get very far in negotiations insisting on more money. A startup typically isn't going to offer you as much salary as you would get if you worked for an established firm. If having a substantial salary and other perks are important to you, taking a position in a startup probably isn't the best fit for you. Especially if the startup is in the early stages and hasn't yet reached all of its funding goals, you're much more likely to get somewhere in negotiations if you ask for more equity than if you ask for a higher salary. Consider that in some startups, the founders or company leaders with whom you're negotiating may have agreed to forego salaries. If the company is in the early stages, you may be able to negotiate salary increases when additional funding is raised or when the company's product starts generating revenue.

Limit your negotiating points to cash and equity compensation. When you present the company with your counter-offer, avoid getting stuck on issues that won't affect the bottom line. Haggling over other terms of your offer will only distract from what's really important and make negotiations take longer than they should. There may be terms or conditions to your equity plan that you don't especially like, but if they won't have much impact on the value of your equity or the amount of cash in your pocket (either now or in the future), they're not worth the time or effort to debate them. The company may choose to give you what you want on these minor points but refuse to budge on anything else. This could leave you no better off than when negotiations began. Keep in mind that fancy job titles or perks such as parking or gym memberships won't provide much long-term value.

Emphasize what you bring to the company. When you present your counter-offer, you can remind the company why they wanted you in the first place and what you bring to the table. It won't be in your best interest to make it personal or to talk about offers from established companies. These people simply may not have the funds with which to compete. If there's something specific that you can do better than anyone else on the team, that should be enough to make you an essential early employee worth preferential equity compensation.

Decide whether to accept the offer. You should conclude negotiations with the company's second offer rather than coming back with a second counter-offer. If the company responds to your counter with a second offer, you may want to have your accountant or attorney look it over. Be prepared, however, to make a final decision with or without their help. Keep in mind that even if you'd like to take your time to evaluate all the nuances of the offer, taking too much time can kill the deal. If you wait too long to respond, the company may make your decision for you by hiring someone else.

Comments

0 comment