views

- Search for property liens on your local county recorder’s website, or visit their office in person. You may be charged a small fee for obtaining the record.

- Use a third-party service like PropertyShark to get a list of liens against a property, or purchase a detailed lien report from USTitleRecords.com.

- Hire a title company to conduct a thorough search for liens on a property. They may also be able to assist with getting liens resolved once debts are paid.

Obtaining Lien Records from Your Local County Recorder

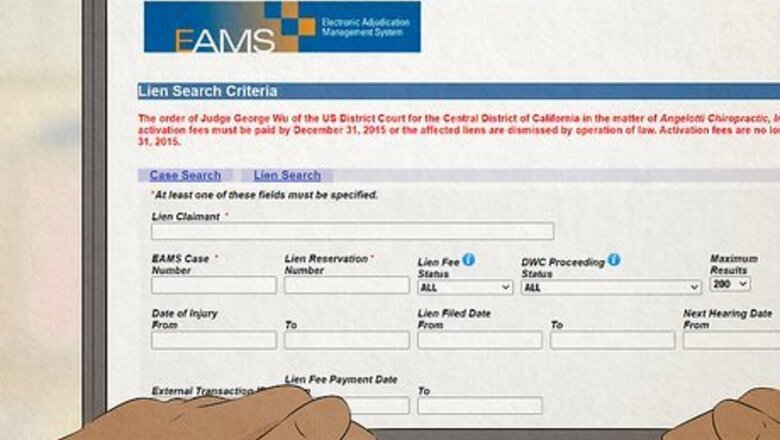

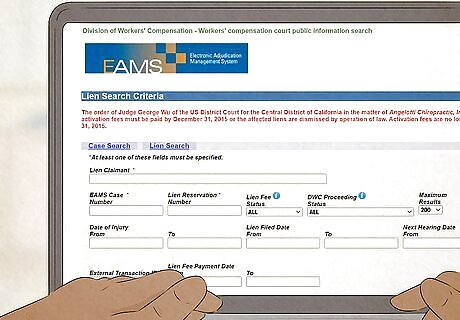

Search for property liens on your county recorder’s website. Many local county recorders allow you to search property records online, including liens. Locate the public records search feature on your county recorder’s website. Then enter the address of the property you’re looking for and filter by “liens.” You may need to pay a small fee to download the record. If you can’t locate the website using Google, contact the county recorder’s office by phone to request the website for searching for liens on a property. Each county recorder’s website is different, but most allow you to sort by document type (liens, mortgages, deeds, etc.). Louisiana uses the term “parish” instead of “county.” Alaska uses “borough.” Use these terms if you’re researching property in either of these states.

Visit your county recorder’s office to search for liens in person. If lien records aren’t available from the county recorder’s website, visit their office to submit a records request. Provide the address of the property you’re researching, then ask for all public records of liens on the property. There may be a small fee for obtaining the record. Contact the recorder’s office in advance to ask if there are specific procedures for requesting records of liens. For example, you may need to meet with a specific staff member who is only available on certain days. Make sure to visit the county recorder during their business hours. Check their website or contact them by phone to find out when they’re open.

Using Third-Party Websites

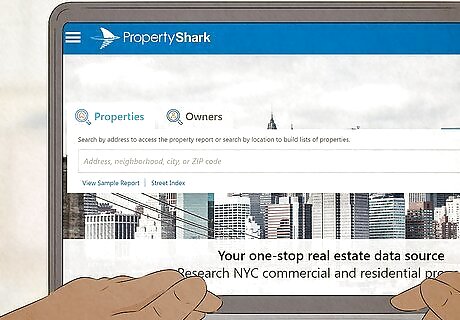

Get a list of liens on a property from a property records website. Google property records sites that let you create a free account, like PropertyShark.com, and search for lien records on your property. Then, download a property report for the property you’re interested in (you may have to pay a small fee). Liens will be listed in the property report alongside other title documents, like deeds and mortgages. In some cases, property reports may only list liens against the property itself. They may not include liens against the owner, such as judgments from a lawsuit that require the owner to use profits from the sale of their property to cover court settlements.

Buy a detailed lien report from U.S. Title Records. Go to the Full Property/Owner Lien Report page on the U.S. Title Records website. Enter the property’s street address, city, and state, plus any apartment or suite number. Select “Proceed to Checkout” to be redirected to a billing page where you can enter your payment information. The report costs $195. The report provides detailed information on all liens against the property and owner, including tax liens and judgments (such as settlements from a lawsuit) that the current owner needs to pay using the profits from selling the property. Search for similar websites specific to your state, too, if the U.S. report is too expensive or you can't locate your property in their database.

Using a Title Company

Hire a title company to conduct a title search on the property. A title company is a business that conducts research on properties on behalf of prospective buyers. For around $150, the company will search for any liens on the property and its owner, including tax liens, contractor liens, and judgment liens. Search online or ask a real estate agent to recommend a reputable title company in your area. Hiring a title company is worth it if you’re seriously considering buying a property, or if you want to be 100% sure whether there are any liens on your property. The title company will be extremely thorough and may have direct contacts in the local county recorder’s office. If you decide to buy the property, the title company can continue working with you and the seller to resolve liens and verify that the owner can legally sell the property, among other tasks.

What is a Property Lien?

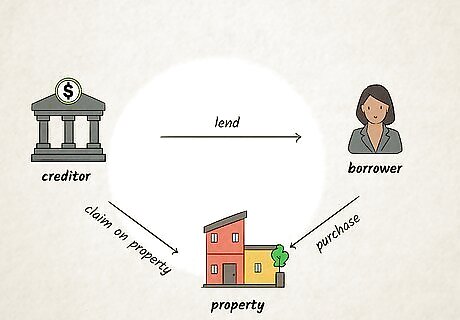

A property lien gives a creditor rights over a property to cover unpaid debt. For example, say a plumber does $10,000 worth of work on a house, but never gets paid. The plumber can file a lien for $10,000 against the property. If the property is foreclosed, the plumber is legally entitled to receive $10,000 from the profits of the foreclosure. In this example, the creditor is the plumber. However the creditor can be anyone who the property owner owes money to. If the property owner pays the debt, the lien is resolved and the creditor automatically forfeits their rights to the profits from a sale or foreclosure.

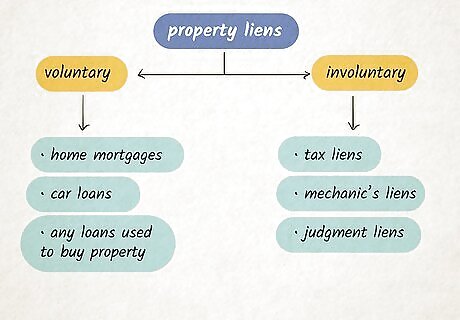

There are two types of property liens: voluntary & involuntary. A voluntary lien is a legal agreement in which a creditor lends money to a borrower who buys a property. The creditor holds the property as collateral until the money is paid back. An involuntary lien is used when a debtor owes money to a creditor, but fails to pay. The creditor files a lien to force the foreclosure of the debtor’s property to pay off the debt. Examples of voluntary liens include home mortgages, car loans, and other loans used to buy property. Common involuntary liens include tax liens, mechanic’s liens, and judgment liens. Tax liens result from unpaid property taxes, or unpaid income taxes owed to the IRS. A mechanic’s lien is imposed when money is owed to a contractor for work done on a property. Judgment liens result from lawsuits where a judge has ordered the property owner to use the profits from the sale to pay settlements and court fees.

What to Do if You Find a Lien On Your Property

Pay off the debt to resolve the lien, if possible. If you have the financial means, paying off the debt is the simplest way to have a lien removed from your property. Once the debt is paid, the creditor—that is, the person you owed money to—can file a lien release to have the lien removed. If you don’t have the means to pay the debt right away, ask the creditor if you can pay off the debt in installments. For example, if you have an IRS lien due to owing back taxes, request a payment plan that allows you to pay your taxes over time, rather than in one lump sum.

Negotiate to have the lien removed for less money. Reach out to the creditor and ask them to remove the lien in exchange for you paying part of the debt upfront. Negotiate a plan to pay off the remaining debt after the lien is removed, or ask them to forgive the remaining debt in exchange for more money upfront. If the creditor agrees to remove the lien for a lower amount, get the agreement in writing. For example, you could send a signed letter outlining the terms of the agreement. Be sure to ask for a written response affirming the terms of the agreement.

File a lawsuit to have the lien removed. If an attorney believes you have legal cause to sue, they can file a lawsuit to have the lien removed from your property. This is a valid option if local laws permit you to challenge a lien in court, or if the creditor fails to file a lien release after the debt is paid. A lawsuit may be expensive and time-consuming. However it could be worth it if you’re at risk of losing your home, or if the lien was not filed legally. Only an attorney can determine if you have grounds to sue. If you don’t have grounds, your attorney may advise against suing. Most states have laws requiring a lien holder to file a lien release within a certain timeframe after the debt is paid. If they fail to do so, you may be entitled to receive compensation for court fees and attorney fees if you decide to sue.

Obtain a lien release if the debt has already been paid. Contact the creditor to have them file a lien release. A lien release is a formal letter stating that the debt has been paid in full. The creditor will need to file the lien release with the same county where they filed the original lien. Once the lien release has been filed, the lien will be removed. A lien will stay on your property until the lien release has been filed. It doesn’t get removed automatically when the debt is paid off.

What to Do If You Find a Lien on a Property You Want to Buy

Determine whether the debts have been paid. Contact the creditors yourself and ask if the debts have been paid off. If they’ve already been paid off, ask the creditors to submit a lien release so that you can purchase the property. The liens will not be removed until each creditor files a lien release. If the debts haven’t been paid, the seller will need to settle those debts before the house can be sold.

Offer to pay the debts if you’re adamant about buying the property. If the property you’re interested in is your dream home, contact the seller and offer to cover the cost of their debts in exchange for buying the property from them. This may not be worth it if the debts are too high, but ultimately it’s your decision. If the seller agrees, have an attorney draft a legal agreement requiring the owner to sell the property to you upon payment of the debts.

Comments

0 comment