views

What to Do if You Crash While Driving for Uber

Make sure everyone is safe. After an accident, the most important thing is making sure everyone in the vehicle is okay. If anyone is seriously injured, avoid moving them until help arrives. If the vehicle is in a dangerous position or blocking traffic, move it to a safe spot nearby, if possible.

Contact the authorities. Always call emergency services if an accident results in injuries or serious vehicle damage. If you’re driving for Uber, it’s helpful to call the police even if the crash was relatively minor. The police report may be helpful when you file a claim with Uber’s insurance.

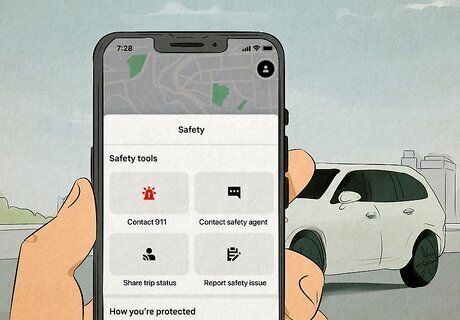

Report the incident to Uber. Contact Uber through your Uber Driver app. To do this, pull up the map and tap the blue shield icon in the bottom left corner of the screen. This will bring you to your Safety Toolkit. From here, select “Report a crash.” Fill out the form describing what happened, then hit “Submit.” If you’re the driver and you’d like to speak to an Uber support representative, open your app and navigate to “Help” > “Safety” > “Safety Incident Reporting Line.” Uber will contact you shortly with information about how to file a claim.

Exchange information with the other people at the scene. Get the contact information of the other drivers and passengers involved in the crash. It’s fastest to snap a picture of their driver’s license and insurance card, but you can write it all down if you want. If there were any witnesses nearby who weren’t involved in the accident, get their contact information as well. Write down the license plate number and/or VIN of any vehicles involved in the accident.

Document the scene. Once it’s safe to do so, take pictures or video of the damage to both cars. Try to get different angles of the damage if you can. If you can do so safely, take pictures of the area surrounding the accident. Include any road signs or traffic signals, plus any obstructions that might have contributed to the accident. Also, write down the police report number for your insurance claim (if one was issued). Do not put yourself in a dangerous situation while you’re taking pictures—stay out of the road and away from jagged edges or broken glass. As soon as you can after the accident, write down what happened to the best of your recollection.

Get medical help and document any injuries. If you’re hurt—even if it doesn’t seem serious at first—see a doctor as soon as you can. Keep copies of any medical records, bills, or other injury-related expenses. Documentation is important for injury claims. If you miss time from work because of your injury, document that for your claim as well.

Talk to a car accident attorney for help filing your claim. If you’re injured or your vehicle was damaged in an Uber crash, it’s a good idea to reach out for legal assistance. Most personal injury lawyers offer free consultations. Navigating insurance claims can be tricky, and an experienced attorney can be helpful for larger claims. If you have a relatively small claim, like for slight vehicle damage or a minor injury, it may not be worth the cost of hiring an attorney.

What to Do if You Crash While Riding in an Uber

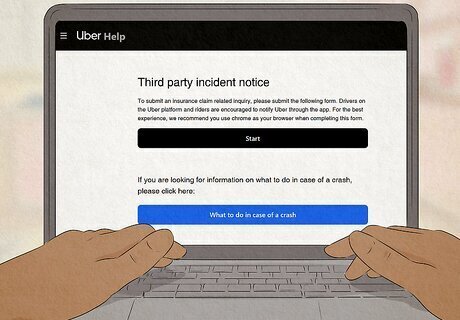

Report the accident to Uber. After making sure everyone is okay, go here and report the accident to Uber. It’s a good idea to do this even if the Uber driver reports the incident—the more documentation around the accident, the better. If the Uber driver didn’t contact authorities, you may want to do that, as well—especially if anyone is hurt or there’s serious vehicle damage. If you were hit by an Uber driver but you weren’t in the car, report the accident here.

Get the contact information of anyone at the scene. Write down your driver’s contact information or take a picture of their license—it will be stored in the app, but it’s better to over-document. Also, take down the information of the other drivers, passengers, and witnesses at the scene, even if the driver also exchanges information with them—you may need it for your own claim. If the police are called to the scene, write down the police report number.

See a doctor and keep records of your appointments. If you’re injured at all, even if it’s minor, get medical help as soon as possible. Make copies of your medical bills and other expenses, as well as records like X-rays. These will be helpful if you need to file an injury-related claim.

Consult a personal injury lawyer for help with your claim. Filing an insurance claim for an accident-related injury can be complicated. Having good legal representation may make it easier to get what you’re owed, especially if you have significant expenses as a result of an injury. Most car accident attorneys offer free consultations to evaluate your case.

How does Uber’s insurance work for drivers?

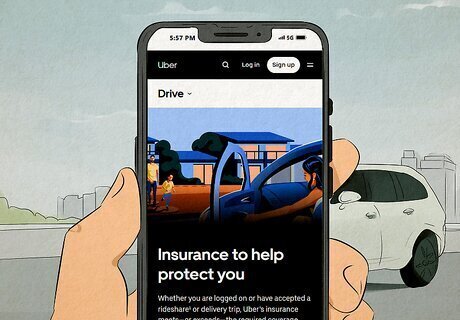

Uber’s insurance coverage for drivers depends on the stage of the trip. If you’re a driver, Uber’s insurance starts covering you when you tap “GO” on the Uber app to make yourself available for ride requests. But a different tier of coverage kicks in when you’re driving with a passenger, including when you’re on the way to pick them up. If you cause an accident while waiting for a ride request: Uber’s insurance will pay for medical bills and property damage resulting from an accident that you caused, up to your coverage limits. These limits can vary depending on where you live—in the U.S., they’re usually $50,000 per person for medical bills (up to $100,000 per accident) and $25,000 for property damage. If you cause an accident while on the way to pick up a passenger or on a trip: Uber’s insurance will pay the passenger for any injuries or damage to their property if you cause an accident. In the U.S., the coverage limit is typically $1,000,000 per passenger. If another driver causes the accident: If the other driver doesn’t have enough insurance to cover the damages, Uber’s insurance will cover medical expenses for you and your passengers, up to your coverage limits. If your vehicle is damaged while you’re driving for Uber: Uber will pay for damage to your car up to its actual cash value after you pay your deductible, regardless of who caused the accident. (The deductible can vary but is usually $1,000 or $2,500).

How does Uber’s insurance work for passengers?

Uber’s insurance covers passengers during the ride. If your Uber driver causes an accident, Uber’s insurance will pay for your medical bills and property damage up to a certain amount ($1,000,000 per person in the U.S.). If another driver was at fault, you’ll file a claim against their insurance. Uber’s policy will also pay for your damages if the other driver can’t be identified, doesn’t have insurance, or doesn’t have enough insurance to cover your expenses.

Can you sue Uber if you get into an accident?

No, you’ll usually file a claim with the at-fault driver’s insurance instead. If another driver was responsible for the crash, you’ll file a claim with their insurance. If the Uber driver caused the collision, you’ll file a claim with Uber’s insurance. You typically won’t need to file a claim with your own personal insurance, whether you’re the driver or the passenger. But there are a few exceptions: If you’re the driver and you purchased additional rideshare insurance. If you’re the driver or passenger and you have medical payments coverage (MedPay) or personal injury protection (PIP)—types of auto insurance that may help pay for injuries sustained in a car accident, even if you’re in someone else’s car.

You can sue Uber if you can prove they hired the driver negligently. If you discover—and can prove—that Uber knowingly hired a driver who shouldn’t have been on the road, you may be able to sue them. However, this is uncommon, as Uber screens their drivers.

FAQs

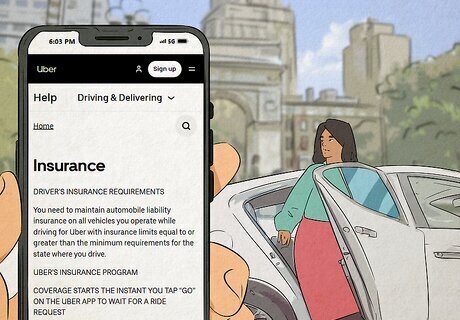

Are Uber drivers required to have insurance? Yes, Uber drivers are required to maintain a personal insurance policy. Additionally, they’re covered by Uber insurance while they’re waiting for a ride, on the way to pick up a passenger, or on a trip. Uber drivers may be able to purchase additional rideshare insurance to supplement their personal policy, but this isn’t required to drive for Uber.

Can you drive for Uber after an accident? Uber doesn’t publicly share their policy on whether drivers can continue working for the platform after an accident. However, if you cause an accident, especially if it’s serious, it’s likely that Uber will deactivate your driving account.

How long does an Uber settlement take? In the case of a simple accident, your claim may be resolved in as little as a few weeks. But depending on the circumstances, it can often take months or even years for car accident settlements to be completed.

What happens if an Uber driver hits your car? If you’re in an accident that was caused by an Uber driver, get the driver’s contact information, including their name and address. Report the accident to Uber to start the process of filing a claim through their insurance.

Comments

0 comment