views

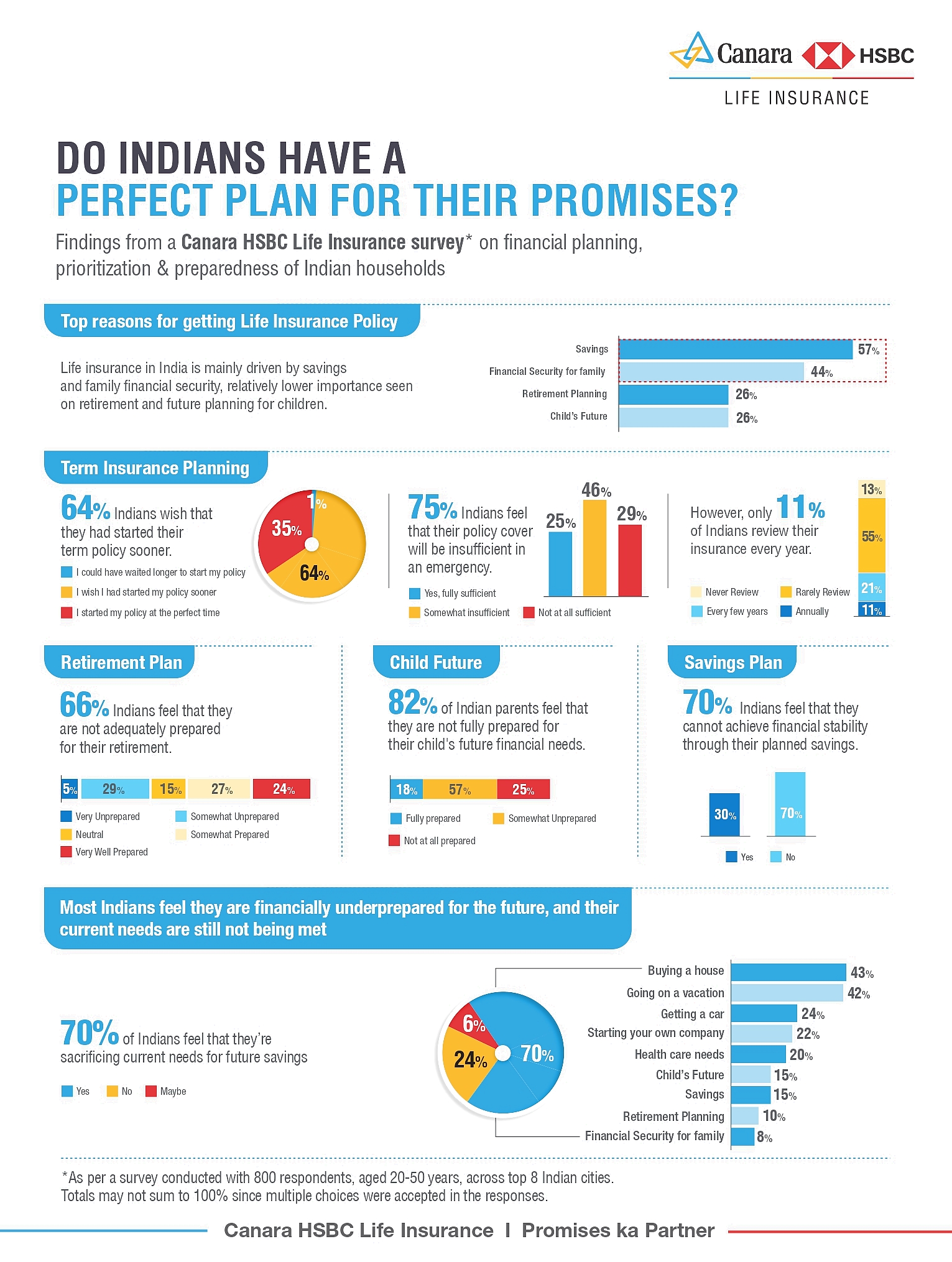

Imagine yourself navigating the demands of daily life—balancing your career goals, family obligations, and the constant pursuit of a secure future. But, as many Indians have discovered, the journey to financial stability is often marked by overlooked opportunities and postponed decisions. This insight forms the core of Canara HSBC Life Insurance’s “Perfect Plan Ka Partner” survey—a study that explores how well-prepared Indians are for the future and how they manage their savings and insurance.

The survey attempts to understand how individuals across various age groups and cities in India prioritise their financial future. The survey, encompassing 800 participants aged 20 to 50 from eight Tier 1 and Tier 2 cities, unveils a compelling narrative: a story of aspirations, regrets, and the quest for security.

The findings reveal a striking reality. Approximately 70% of Indians are setting aside immediate desires, like purchasing a home or taking a much-needed vacation, to prioritise their family’s financial security.

Saving and securing their loved ones’ future emerge as the primary reasons for opting for life insurance policies. However, this focus on family often comes at the expense of other financial goals, with 60% of individuals zeroing in on just one priority—family financial security—while overlooking the importance of savings.

Delving deeper, the survey reveals that 64% of individuals wished they had begun their term insurance journey sooner.

Despite 83% acknowledging the importance of term plans, a mere 11% take the time to review their coverage annually. This lack of regular assessment leaves only 25% of Indians feeling confident that their policy will sufficiently cover unexpected expenses.

The story continues with retirement planning. While 66% of Indians start planning for retirement in their 30s, a staggering 74% regret not starting earlier. This delay has left only 27% feeling prepared for retirement, and just 24% believe their maturity amount will fully meet their financial needs.

The narrative takes a moving turn when it comes to planning for their children’s future. Only 18% of Indian parents feel fully prepared, and an equal percentage believe their policy’s maturity amount will be enough to secure their child’s future.

The regret is palpable, with 71% wishing they had started the policy sooner and 82% of parents feeling unprepared for their child’s financial needs.

Rishi Mathur, Chief Distribution Officer – Alternate Channels and Chief Marketing Officer, Canara HSBC Life Insurance said, “These findings emphasise the need for early and regular financial planning. We believe that with the right guidance and timely decisions, every individual can achieve their financial aspirations and secure a better future for themselves and their loved ones.”

Comments

0 comment