views

New Delhi: The Union Budget speech can be daunting for those outside the financial circuit or those not familiar with government documents. With Finance Minister Arun Jaitley presenting his last full-fledged Budget ahead of the 2019 General Elections, News18 tells you what to keep an eye on.

FISCAL DEFICIT

Fiscal deficit is the difference between total revenue and total expenditure of the government. The gross fiscal deficit (GFD) is the excess of total expenditure.

Where to find it: In Budget 2017-18, fiscal deficit was mentioned on the 23rd page of the Budget document under Chapter 9: Prudent Fiscal Management. The document for budget 2017-18 is used here.

Fiscal Deficit in Budget 2017-18.

Why it’s important: Fiscal deficit is an indicator of the amount the government needs to borrow. More the borrowings, more monetary pressure on the government. Once expenditure is significantly higher than revenues, the government automatically starts spending less, which adversely affects welfare schemes and measures that need money.

GROSS DOMESTIC PRODUCTION (GDP)

GDP is the final value (in rupees) of the goods and services produced within the geographic boundaries of a country during a specified period of time, normally a year.

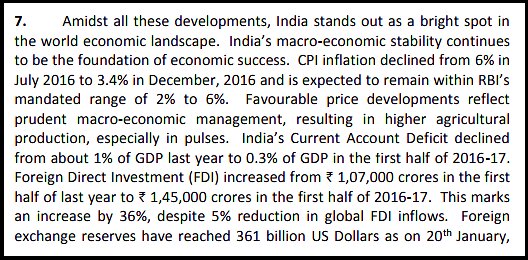

Where to find it: GDP is the one term that is used in the Budget speech the most. The GDP outlook is mentioned right in the beginning of the Budget document. Last year's Budget had GDP discussions on page 4, under the Introduction itself.

GDP mention in Budget 2017-18.

Why it’s important: GDP represents the economic health of a country. It presents a sum of a country's production, which consists of all purchases of goods and services produced by a country and services used by individuals, firms, foreigners and governing bodies. GDP growth rate is an important indicator of the economic performance of a country.

CURRENT ACCOUNT DEFICIT (CAD)

Much like fiscal deficit, current account deficit is the difference between a country's import bill and export bill. Ideally, the export bill should be higher than the import bill.

Where to find it: Last year's Budget had CAD discussions on page 4, under Introduction.

Current Account Deficit mention in Budget 2017-18.

Why it’s important: A Current Account Deficit means that the value of goods and services imported is greater than the value of exports. It requires capital/financial flows to finance this deficit. A large current account deficit is a sign of an unbalanced economy and could lead to a depreciation in the currency. It also puts pressure on the country's treasury.

PERSONAL INCOME TAX

Personal Income Tax is the most sought-after announcement of the Budget. Any individual who earns above the tax exemption limit looks forward to Income Tax rate changes in the Budget every year. Simply put, tax paid by an individual on the money he/she earns is personal Income Tax.

Where to find it: The last Budget mentioned change in personal Income Tax rate on the 35th page as part of 'Other Measures in Financial Sector' under annexes.

Income Tax mention in Budget 2017-18.

Why it’s important: Personal Income Tax is the most popular part of the Budget for the common man as it determines the amount that he/she needs to pay to the government from monthly remuneration and affects the pocket directly. Thus justifying its categorisation as direct tax as well.

INFLATION

Inflation is the rise in price of goods and services over time. Basically, when one needs to spend more to acquire the same amount of a commodity, it’s inflation.

Where to find it: Budget 2017-18 had inflation discussion on page 4, under Introduction.

Inflation mention in Budget 2017-18.

Why it’s important: Inflation increases the cost of living along with reducing the purchasing power of each unit of currency. Lesser goods available for the same amount of money. Therefore, while inflation is inevitable, keeping a check on it is important.

SUBSIDY

Subsidy is the transfer of money from the government to an entity. It leads to fall in the price of the subsidised product.

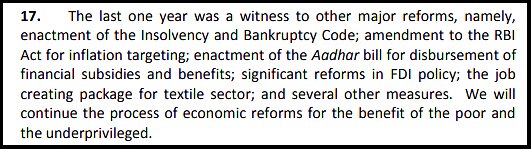

Where to find it: Last year's budget had subsidy discussions on page 7, under Introduction.

Subsidy mention in Budget 2017-18.

Why it’s important: The objective of subsidy is to bolster the welfare of the society. It is a part of non-planned expenditure of the government. Subsidies reduce market price of goods along with providing economic help to producers.

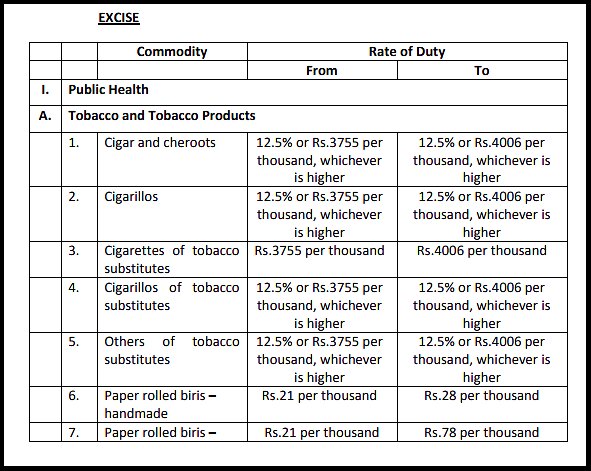

EXCISE

Excise duty is the tax levied by the government on items that are produced within India.

Where to find it: Excise on goods is found at the end of the Budget document.

Excise duty mention in Budget 2017-18.

Why it’s important: Excise duty has the same effect on the pocket as taxes. Higher excise duties increase prices of products.

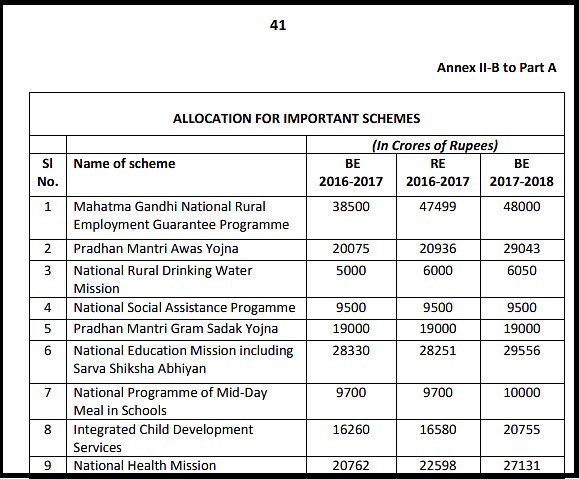

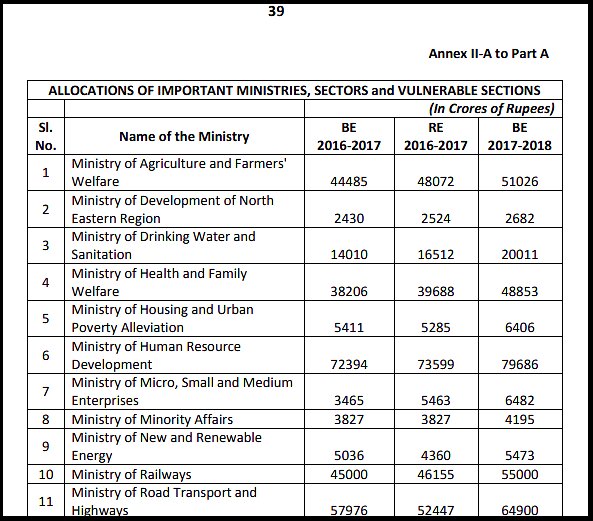

Allocations for schemes happens to be in the final few pages of the document.

Allocations to ministries is the last part of the Budget document.

Comments

0 comment