views

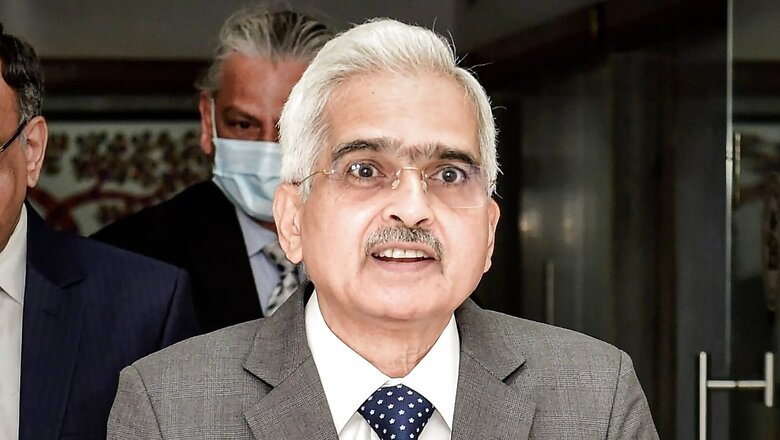

Reserve Bank of India governor Shaktikanta Das has once again came down heavily upon cryptocurrencies, saying that the digital assets can create a lot of financial instability in terms of the ability of the central bank to determine monetary policy. Das’ comments came in sync with his and the RBI’s general views on cryptocurrencies, which has been somewhat rigid since 2018. Reiterating his concerns over crypto assets, Das also said that they can lead to the dollarisation of economy.

“Crypto can create a lot of financial instability in terms of the ability of the central bank to determine monetary policy. It can also have an adverse impact on our exchange rate, on capital flows, on banking sector stability and the potential for being used as a tool for money laundering and for illicit transfer of money,” he told ET Now in an interview on Tuesday, August 23.

The RBI governor said that he was happy to sound warnings about cryptocurrencies sent by the central bank, and that many people did not invest in the digital assets.

“I think I am happy that we sounded those warning signals and I would like to believe that a large number of people would have taken note of the warning signals and the concerns expressed by the Reserve Bank and and anecdotally we are aware that many people did not invest in crypto or have pulled out of crypto, thanks to the kind of caution and concerns that emanated from the Reserve Bank,” he said.

It is the small investor who loses money by investing in crypto, Das said, adding that they may crash due to a lack of an underlying base. “The prices of something which does not have any underlying base, will not remain high all the time. Therefore it may crash and it has crashed. Ultimately in a situation like this, it is the small investor who loses money and therefore it is a big risk for the small investors also.”

“The blockchain technology has various applications. The benefits of the technology are already being capitalised and therefore we flagged those concerns. Countries like India are differently placed from advanced economies when there is a talk of dollarization of economy, if I am sitting at the other end of the globe and if I am in the US, I will be very happy,” he said.

Cryptocurrency is not a good thing to happen for an emerging economy like India, but can be suitable for counties like the US, which are advanced economies, as per the RBI governor.

“If I am in India, I would not be happy whether as an individual or as a central banker. It is not a good thing for our economy to happen. Therefore for emerging market economies, since all the cryptos are denominated in the hard currencies by and large dollar, will not work in favour of countries like India. It may work in favour of the advanced economies,” said Shaktikanta Das.

Reacting to his comments, Edul Patel, co-founder and CEO of Mudrex said that while RBI’s stance on cryptocurrencies has always been rigid, they are are capable of creating a more transparent environment.

“RBI’s stance on cryptocurrencies has always been a little rigid since 2018. But, cryptocurrencies are capable of creating a more transparent environment for making transactions using blockchain. It can help small investors to make transactions with lower fees in a secured manner. Cryptocurrencies can aid in diversifiying portfolios from traditional assets. They can also hedge against inflation in times of financial crisis,” he told News18.com.

Read all the Latest Business News and Breaking News here

Comments

0 comment