views

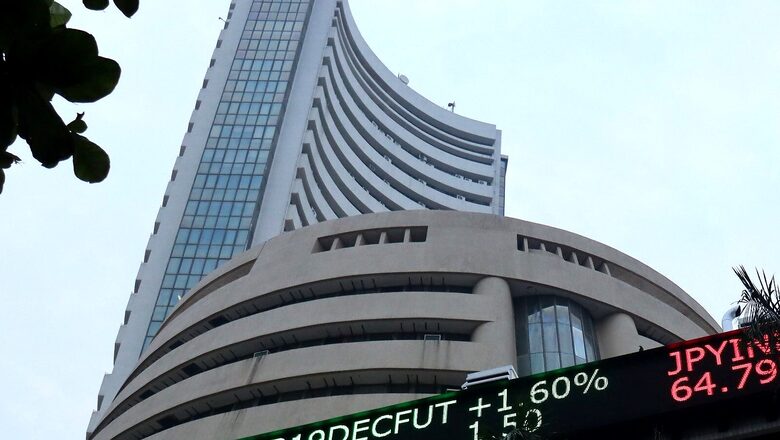

Market started the Budget week on a positive note and extended the rally in next two sessions on the back of growth oriented Budget. However, in the second half of the week, the market remained under pressure amid volatility due to continued FII selling on the back of weak PMI data, rising bond yields & crude oil prices, rate hike by BoE and hawkish ECB’s stance. In the last week, BSE Sensex added 1,444.59 points (2.52 percent) to end at 58,644.82, while the Nifty50 rose 414.35 points (2.42 percent) to close at 17,516.3 levels.

Sachin Gupta, AVP, research, Choice Broking, said: “The nifty50 index slightly retreated from the weekly high of 17,794.60 and settled at 17,516.30 levels with weekly gains of 2.3 per cent. Overall, both the indices have performed well in the initial three days of the week, thereafter we witnessed further profit booking. All the sector indices ended in green note, the metal sector saw the highest gain of 6.5 per cent followed by the pharma and FMCG sector increased 4 per cent. On the stocks front Vedanta, Tata Steel, Sun Pharma & ITC were the top gainers with average 9 per cent gains while NTPC, M&M, UPL were the prime laggards on a weekly basis.”

“On the technical front, the index has slipped below the prior bearish candlestick on the daily time frame, which points out the weakness in the counter for the time being. Moreover, the index has also traded below middle bollinger band formation and 21-days SMA, which indicates further bearishness for the coming day. On an hourly chart the index has shifted below the Rising Trendline, which suggests a weakness. An indicator stochastic witnessed a negative crossover on a daily scale. At present, the Index has support at 17,250 levels while resistance comes at 17,800/18,000 levels,” Gupta said.

Here are Key Factors that Traders Need to Keep a Close Eye on:

MPC’s Monetary Policy Meeting

Among the important events, participants will be closely eyeing the MPC’s monetary policy review meet next week and its outcome is scheduled on February 9. With the timeline set by the US Fed for tightening, it would be crucial to see how the MPC responds to it especially when the government has set the growth agenda in the Union Budget. Besides, on the macro front, IIP data will be released on February 11.

Earnings this Week

The earnings season has been a mixed bag so far wherein sectors like IT, selected private banking and auto have seen decent performance while consumer-driven sectors like FMCG, consumer durables and pharma have posted a muted show. We have some big names like Bharti Airtel, Jindal Steel, ACC, Hero Motocorp, Tata Power, Hindalco and M&M will announce their numbers during the week along with several others.

FIIs: What it Says

If we look at the derivative data then FIIs’ long exposure in the index future has come out of oversold territory to 41 per cent level which is neutral to negative while the put-call ratio is sitting at 0.9 mark is still in oversold territory, said Santosh Meena, head of research, Swastika Investmart Ltd

Global Cues to Impact Stock Market this Week

“Global cues are also not clear where the geopolitical situation is important while rising crude oil prices is a key concern for our market. FIIs are still in a selling mood and their behavior will also play an important role in the direction of headline indices,” Meena explained.

Nifty Technical Outlook

Technically, Nifty is halting near 20-DMA after a strong pullback where 50-DMA of 17,438 is an immediate and important support level where if Nifty manages to hold this level then we can expect a bounce back but Nifty needs to cross 17,800 level to gain strength towards 18,300/18,600 levels. If Nifty slips below its 50-DMA then we can expect further weakness where the budget day’s low of 17244 will be the next important support level while 17,000-16,800 is the next demand zone.

What Should Investors do?

Markets have been witnessing volatile swings, mirroring their global counterparts and it may continue in near future. Besides, the upcoming event i.e. MPC’s monetary policy review and earnings would further add to the choppiness. We have been seeing consolidation in the index for the last 3 months and indications are in the favour of prevailing bias to extend. “We thus recommend focusing on sector-specific opportunities while keeping a check on leveraged positions. On the benchmark front, Nifty may find support at 17,350 and 17,000 levels in case the profit taking continues while the 17,850-18,000 zone would act as a hurdle,” said Ajit Mishra, VP Research. Religare Broking.

Read all the Latest Business News here

Comments

0 comment