views

Shares of Larsen & Toubro Ltd (L&T) were trading higher in Monday’s trade as the share buyback opens today. The eligible shareholders can participate by tendering equity shares during normal trading hours of the secondary market of BSE and NSE. The share buyback issue will conclude on Monday, September 25.

Against a book size of up to 3,12,50,000 shares, L&T received bids for 71 shares so far. BSE is the designated stock exchange for the buyback. L&T had recently increased the buyback price to Rs 32,00 from Rs 3,000 earlier, keeping total buyback value unchanged at Rs 10,000 crore. Analysts noted that one of the key objectives of the company’s strategic plan, Lakshya ’26, is to enhance the return on equity (ROE). Return on equity capital to shareholders in the form of share buyback is a step in that direction, Prabhudas Lilladher said in a recent note.

“L&T lifted its buyback price 6.7 per cent to Rs3,200/share reducing the shares to buyback to 31.25 million (2.22 per cen). We expect the buyback to add 125 basis points to ROE versus 12 per cent in FY23. L&T articulated its path to 18 per cent ROE by FY26 being equally split between core E&C improvement, loss reduction in PPP assets, such as Hyd. Metro (read Play on megatrends) and capital return (read Capital return to drive rerating),” CLSA said on September 13.

The engineering and construction major said the acquisition window will be available on both BSE and NSE to facilitate the placing of sell orders by the eligible shareholders, who wish to tender shares in the buyback.

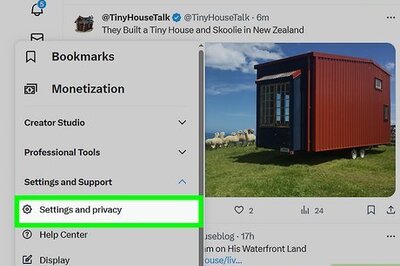

“Eligible Shareholders may place orders in the acquisition window-only through their respective stock broker(s) (along with the complete set of documents for verification procedures) during normal trading hours of the secondary market by giving the details of equity shares they intend to tender under the buyback,” L&T said.

Should you tender your shares?

Market expert Ambareesh Baliga believes that retail shareholders should tender their shares in the buyback.

“The buyback represents L&T’s commitment to returning capital to its investors. With robust cash flow over the years, this move will also help in reducing the company’s debt, enhancing its financial flexibility. In essence, the L&T buyback is a strategic step benefiting both the company and its shareholders, highlighting management’s confidence in long-term growth,” Sonam Srivastava of Wright Research PMS said.

Khadija Mantri, Associate VP – Research, Sharekhan by BNP Paribas, says, “We recommend investors tender their shares in the L&T buyback, as the buyback price of Rs. 3,200 per share is at a premium of nearly 9–10 per cent from its current market price. Although the acceptance ratio and allotment are likely to be low as the company would be buying back only 2.2 per cent of the total equity, which is 3.125 crore shares, this is the first-ever buyback by the engineering conglomerate, and therefore investor interest is likely to be high for the same.”

Comments

0 comment