views

Creating a Saving System

Get four jars. To build up your savings, it is good to have a system. You can use the four jar system to help you decide how to use any money that comes your way. Ask a parent if there are four empty jars that you can use to create your savings system. If there are no jars available, then you can also use four empty soda bottles. You will just need to find ones with a big enough opening to put coins through or make a slit in the side of the bottle with a pair of scissors. Make sure to ask mom or dad first.

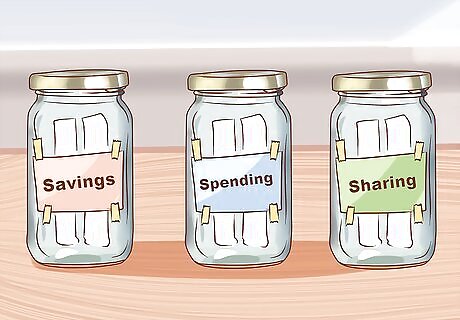

Label your jars. To use the four jar system, you will need to label each jar with a different goal: “Save,” “Spend,” “Give,” and “Grow.” You can decide how much money to allocate to each jar when you find some money. The jar labels each mean something different: Save. Fill this jar with money that you do not intend to spend now or in the immediate future. You might use this jar to save up for a big item, such as a bike or video game system. Spend. Fill this jar money that you plan to use for everyday expenses or for something that you want to buy in the next week. Give. Fill this jar with money that you plan to donate to charity or to give to someone who needs it more than you. Grow. Fill this jar with money that you plan to invest in a savings account that will accumulate interest over the years.

Decorate your jars. To make saving money more fun, try decorating your jars with pictures that inspire you. Cut out pictures from old magazines and tape or glue them onto the jars. Make sure that you ask your parents before cutting picture out of magazines to make sure it is okay. For example, you might put a picture of a bike on your “Save” jar or a picture of someone helping someone else on your “Give” jar.

Use these jars to decide how to use your money. Each time you get some money, you can decide how to divide your money among the four jars. For example, if you get $4, then you could put $1 into each jar or you could put $2 in to the “Save” jar, $0.50 into the “Spend” jar, $0.50 into the “Give” jar, and $1 into the “Grow” jar. It is up to you! Keep your savings goals in mind as you divide your money between these goals. Remember that the more you save, the closer you will be to reaching your goal.

Setting Goals and Habits

Think about what you want to do with the money. One reason why many people don't reach their financial goals or aren't able to save money is because they don't know what they want to do with the money. Do you want to save for college? Buy your own laptop? Buy a car? Deciding what you want to do with your money is the first step on the path to saving it. If you're having trouble figuring out what you want to do, consult the people who know you best: your parents and close friends. Brainstorming with other people who know you very well can help shake loose your own thoughts and re-awaken your dreams and goals.

Choose a savings goal. Once you know what you want to do with your savings, you can figure out how much you should be saving each week or month, depending on when your allowance, paycheck or other source of income is made available to you. Then, every time you get any money, take some out and put it in your savings.

A good rule of thumb is to save $1 out of every $3 you get. Saving one-third of your income might seem like a lot, but it's the only way to really build up your savings into something. Saving one-third or thirty percent of whatever money you receive is one of the best saving strategies out there. Once you start, it will become a habit. Also consider how much you want to have and when. This will help determine how much you need to save each week or month. If you want to have $100 in one year and you get $5 allowance a week, setting aside about $2 each week will get you to that goal. If you want to save money for more than one thing, consider splitting your savings into multiple jars or envelopes. If you keep your money in a savings account in a bank, keep a log where you divide how much of your total savings is going toward each goal.

Ask your parents to help you open a savings account. Getting a savings account is a great way to keep your money save and even earn a little interest on what you save. In addition, having a bank account can encourage good savings habits. If you're under 18 years old, your parents will probably need to be on the account. A joint account is one way that many banks offer accounts to kids. Your parent(s)'s name(s) and your name will be on the account for liability and legal purposes. This may seem like a downside, but it may also make it harder for you to spend your money at will since your parents will know if you make a withdrawal. Look for banks with minimal fees and balance requirements. Many banks have a "Young Saver" option with low or no fees. Keep in mind that some banks may only offer custodial accounts, based on the Uniform Transfers to Minors Act (UTMA). These accounts are investment vehicles that have restrictions on when a child can gain access to the account and its funds (typically 18 or 21, depending on the state). If this is the only option at your bank, try looking into another bank for a standard savings account or waiting until you are a bit older. If you don't want to open up a bank account for whatever reason, you can create your own "bank" by putting your money in a locked container and giving your parents or another trusted person the key. Better yet, so long as you trust your parents to control your money, they can open a new account in their names and deposit the money for you.

Keep track of how much is coming in. Developing and sticking to a budget is only possible if you know how much you have to work with. Figure out and keep track of how much money you have coming in from different sources (e.g., allowances, gifts, earnings, babysitting money, etc.). If you have a bank account, keeping track of how much money you have is easy. You can find your bank statements online or you can go into your bank branch and ask. Print and keep your bank statements in a binder to help keep track of your savings progress. This will also be useful down the line when you have to do your taxes or keep track of your mortgage. There are also smartphone apps that make it easy for you to deposit money into your account. Many banks now allow clients to take photos of checks with their smartphones and deposit them into their bank accounts.

Keep a spending log. Save receipts or keep a chart of all purchases made, even food. List the date, item, and amount spent. That way, you know exactly where your money has gone. There are also personal finance apps that you can download to your smartphone and use to log your spending. Some even let you take photos of receipts that are then calculated in the app. This is a great way to learn about your spending habits.

Spending Less

Carry as little money around with you as possible. Don't carry much cash in your wallet and, should you have any debit or credit cards, try to avoid bringing them everywhere. This way you will not be tempted to spend money on unnecessary items or make impulsive decisions when at a store. Instead of carrying everything you might need (all your available cash, debit card, several credit cards, etc.), carry only what you know you'll need. Stick a few bucks and (if you insist) one credit card in your pocket when you go to the mini-mart, for instance.

Save before spending. Whenever you receive money, whether it be a gift or your allowance, take your savings out right away and set them aside. This will ensure that you don't spend the money you intend to save. The best part is that once you have set aside your savings, you can spend the rest! It is important to enjoy life and live a little bit after all. Think like Uncle Sam. The government takes out income taxes before people get their paychecks. If you take your savings cut out of your income right away and put it somewhere that is not easy to access, it will be easier to forget that it was available to spend in the first place ("out of sight, out of mind").

Spend money on the things that matter. For instance, spending money on your future is almost always wise. You should feel good about spending money when it's an investment in your future and future earning power. For example, save for school if you plan to go to college. If you plan to be a singer, spend money on voice lessons. Spend money on appropriate clothing if you get an office job. It's perfectly acceptable to spend money in order to promote yourself and, in turn, eventually earn more money. To save money on things you need to buy, look for discounts and sales, buy second-hand when you can, and try to reuse things you already have before you replace them. That said, if you are sticking to your newfound saving habits well, a little spending here and there isn't such a bad thing. Think of it as investing in your current happiness.

Place a value on money. Yes, a dollar is a dollar, but what does that really mean? Remember that, for the most part (excepting gifts) money is what you earn for doing something. When you work, you are exchanging money for your time. You need to decide if what you want is worth the time it will take for you to earn the money to be able to buy it. For example, if you get an allowance of $5 per week and you want to buy a video game for $50, then you will need 10 weeks of allowance money to buy the game. That will take a long time to save, so think about whether or not it is worth it to you. Further, can you buy that game and balance your other needs for the money, such as putting money into your “Spend,” “Give,” and “Grow” jars? Each time you spend money, it represents a trade-off. You need to think carefully about what you value and make decisions accordingly.

Earning and Saving More

Take on odd jobs for neighbors and friends in the community. Obviously, one of key things about saving money is that you have to have money to save. Earning more gives you more chances to save more. Even though you may not be old enough to get a traditional job, there are ways that you can earn some extra money. Start a lawn mowing business in the summer and a snow shoveling business in the winter. You can even rake leaves for neighbors in the fall. Charge different fees depending on the amount of work to be done and on how large the lawns are. You can advertise your services by making up flyers and sticking them on posts and asking your neighbors to put them up on their doors. Provide pet care services for friends or neighbors. Pets need a lot of care and many pet owners would rather entrust their pet to a responsible child or teenager than send them to a kennel. House sit for neighbors when they go away on vacation. Look after their pets, water their plants, and pick up their mail. This is a great way to be both neighborly and to gain a little extra something on the side.

Sell stuff. Host a neighborhood bake sale or lemonade stand in the summer. Take your used video games to a local games store, or your old but still-in-good-condition clothes to a consignment shop. If you're familiar with buying-and-selling online, consider selling old baseball cards, electronics or collectibles over various well-known sites. Hold a garage sale once or a couple of times a year. There are lots of great ways to make a little extra money by offering a product for sale or by trading in your old stuff for cash. Be creative so you can meet your savings goal!

Save "unearned" money. If you get some cash on holidays or your birthday, always save at least half of that. Some families even give children savings bonds for college or money earmarked for long-term savings. Put those in the bank though, not in your piggy bank. Remember about the "out of sight, out of mind" principle. Take out your savings share and put it away immediately. Convince yourself that you only got $60, not $120 for your birthday by making half of it "disappear" right away.

Save your change! Put all of your spare change from leftover lunch money or what have you into a glass jar or piggy bank and cash it in every once in a while. You will be surprised at how much you can save without even really trying very hard! Many banks (especially if you have an account there) have change-counting machines that don't charge fees. So don't worry about those little paper sleeves for pennies, etc.

Negotiate with your parents. See if your parents will “match” your savings in order to encourage you to develop good saving habits. Let's say you save $40 a month and put it into a savings account. You could ask if your parents would be willing to match your savings and add $40 of their own. Akin to the "matching donation" idea that charities employ, this method will provide you with extra incentive to save. Your parents may or may not support the idea, but they might be more willing to do so if you're saving for something that is important to them, like your education.

Comments

0 comment