views

- For salaried workers, your hourly rate is your salary divided by the number of hours worked in a year. For a 40 hour workweek, you can assume 2080 hours per year.

- If you’re self-employed, your hourly rate is your income over a specific time period, divided by the number of hours worked during that time (including unpaid hours).

- If you earn cash tips, your hourly wage your total earned in tips divided by the number of hours worked, plus whatever wage you make on your paycheck.

- These calculations don’t account for taxes, which will vary depending on many factors, including where you live.

Hourly Rate from Salary

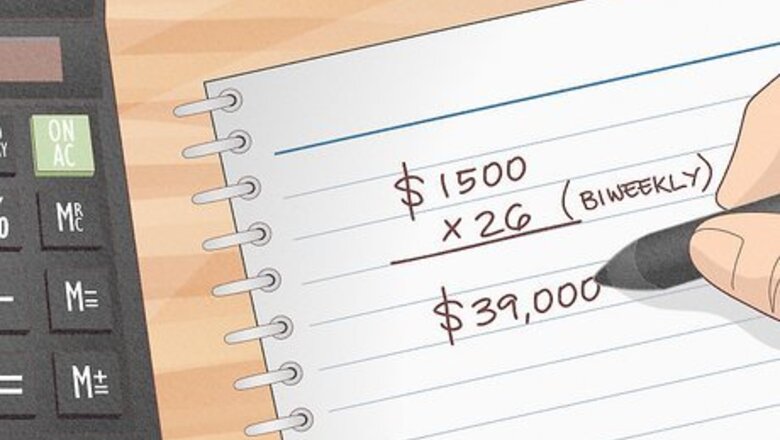

Determine your annual salary. If you know the number offhand, move on to step 2. If not, find your gross pay on your most recent pay stub. Your gross pay is the amount you get paid before taxes, benefits, and other deductions. Then multiply your gross pay by the number of pay periods in a calendar year. This number is your annual salary. For example, let’s say your gross pay is $1500 and you get paid biweekly (every 2 weeks). This means you’d have 26 pay periods per year. So your annual salary would be $1500 x 26, or $39,000. If you get paid weekly (once per week), you have 52 pay periods per year. If you get paid semimonthly (twice per month), you have 24 pay periods per year. If you get paid monthly (once per month), you have 12 pay periods per year.

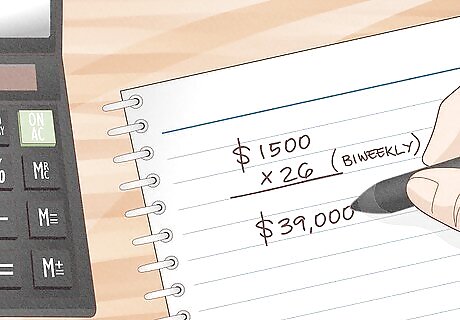

Calculate how many hours you work per year. Multiply the number of hours you work per day by the number of days you work in a week. Then multiply that number by 52. For example, let’s say you work 8 hours per day, 5 days per week. In this case, you’d multiply 8 x 5, which equals 40. Then multiply 40 x 52, which equals 2080 hours worked per year. If you don’t have fixed working hours, use an approximation for the average number of hours you work per day. For instance, if you often work 8-10 hours per day, you can use 9 hours per day as an approximation.

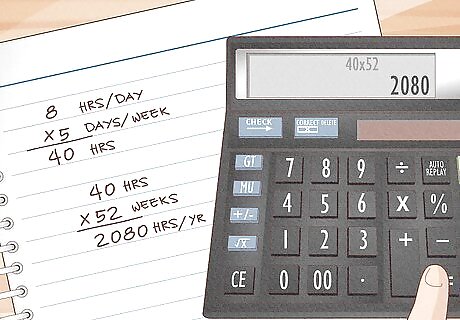

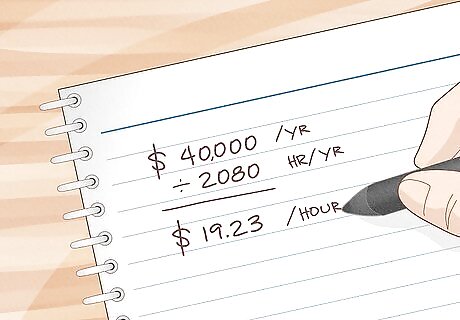

Divide your salary by the number of hours worked per year. For example, if your salary is $40,000 and you work 2080 hours per year, then your hourly rate = $40,000/2080. This comes out to $19.23 per hour. This calculation doesn’t account for overtime, bonus pay, sick pay, vacation pay, or other variables. For example, some jobs may offer overtime pay that is above the equivalent hourly rate for your base salary. For instance, say you have a base salary of $40,000, but your job offers $25/hour for overtime pay. If you work a lot of overtime, then your average hourly rate might be higher than it would be if you didn’t earn overtime pay. To approximate your net hourly rate (or, what you max after taxes and deductions), divide your net pay on your most recent paystub by the number of hours you worked during that time period. For example, if your paystub says your net pay was $1330 and you worked 70 hours, your net hourly rate after taxes and benefits is $1330 divided by 70, or $19/hour.

Hourly Rate For Self-Employment

Add up your income for a certain time period, like a specific month. Your income is the money you make after deducting expenses. For instance, if you’re calculating income for the month of August, add up all the money you made during that month. Then deduct your expenses during that month. For example, imagine that you’re a landscaper and you made $8,000 in August. However, you also spent $2000 on equipment, hired labor, and other costs. Therefore, your income for the month of August was $8,000 minus $2,000, or $6,000. This calculation doesn’t account for taxes, which can vary a lot depending on your country or city. If you’re self-employed in the United States, you’ll have to pay 15.3% in federal taxes, plus state and local taxes—but the exact amounts change from person to person.[Calculate-Self-Employment-Tax-in-the-U.S.|Calculate your self-employment tax]] or talk to an accountant in your area to get expert help.

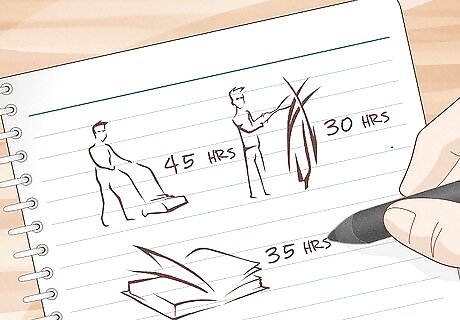

Determine how many hours you worked. For example, if you want to calculate your hourly rate for the month of August, keep track of all hours worked during that month. Include unpaid hours in your total, such as time spent commuting, buying supplies, or reaching out to customers. For example, imagine that you’re self-employed as a landscaper and charge customers $100/hour for labor. In addition to those paid hours, you spend many hours per month doing bookkeeping, shopping for tools, or completing other tasks for your business. All of this counts as work, even if a lot of it is technically unpaid.

Divide your income by the number of hours you worked. This will give your hourly wage during a specific time period. For example, let’s assume you made $3000 in the month of August and worked 120 hours total (including unpaid work). Your hourly wage for the month of August equals $3000/120, or $25/hour. To calculate your average hourly wage for a whole year, keep track of all the hours you work for that year, including unpaid work. Then divide your income (total money you make, minus expenses) by the number of hours you worked. If you make roughly the same amount of money every month, and work roughly the same number of hours, you can calculate your hourly rate for an average month. This will give you an approximate hourly wage for the year.

Hourly Rate for Cash Tipped Jobs

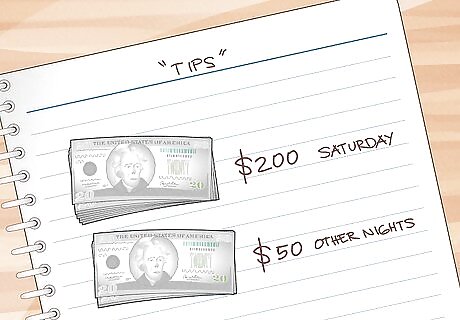

Add up all cash tips you made during a specific time period. You can do this for a single workday, a specific month, or a whole year. Since cash tips can vary a lot, you might want to choose a time period of several weeks or months to get a clearer picture of your average hourly wage. For example, say you’re a waiter who makes $200 in tips on busy Saturday nights, but only makes $50 on other nights. You might prefer to calculate your average wage from tips over a whole month, since your income on Saturdays doesn’t reflect your typical income.

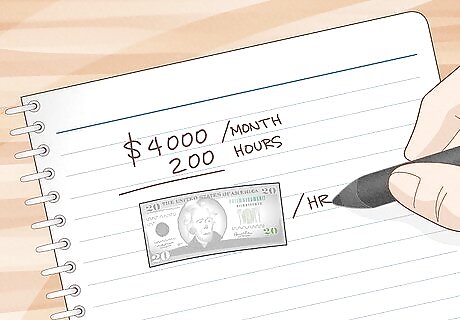

Divide your total cash tips by the number of hours worked. For instance, say you made $4000 in cash tips last month and worked 200 hours. Your hourly wage in tips would be $4000/200, or $20/hour in cash tips. Since tips can vary from day to day, this number is an average for the time period you chose. This amount doesn’t include your hourly paycheck, which is separate from cash tips.

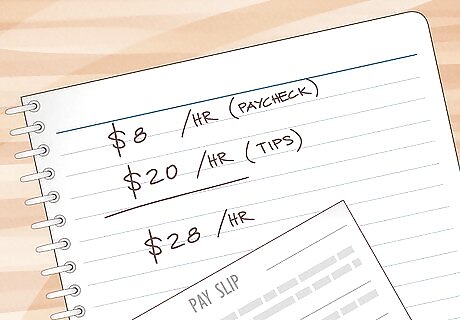

Add your hourly wage from tips to the wage on your paycheck. If you make an hourly wage in addition to tips, your total hourly wage is the combination of both wages. Using our example above, let’s assume you made $20/hour in cash tips and $8/hour from your paycheck. Your total hourly wage for that time period would be $28/hour before taxes. To calculate your salary for the year, multiply your total hourly wage by the number of hours you work in a week. Then multiply that number by 52. For example, if you make $28/hour and work 30 hours per week, your approximate annual salary equals $28 x 30 x 52, or $43,680 per year. This calculation doesn’t account for taxes on tips. Technically, you’re required to report tips on your federal and state tax returns if the total amount of tips exceeds $20 per month. If you report tips on your tax return, you’ll receive a tax bill from the IRS and your state after filing. Your exact tax bill will depend on how much you made and the state where you’re employed.

Comments

0 comment