views

Determining Your Resident State

Take note of where you live the most. You must file taxes as either a “resident,” “non-resident,” or “part-year” resident. As a general rule, your resident state is the state you live in. In other words, this is the state you go back to after a vacation or a business trip. Determine if you are domiciled in the state. For tax purposes, most states will consider you a “resident” if you are domiciled there. To be domiciled in a particular state, you must have been physically present in the state and consider it your home state. For example, you move from state A to state B. After you move, you consider state B your home. Therefore, state B is your domicile, and you are a resident of state B. However, if you move from state A to state B but plan to return to state A within a few months, then state B is not your domicile because you do not consider it your new home. Living in a state temporarily (even for long periods of time) doesn't make it your domicile unless you intend to make it your permanent home. Nevertheless, because intent can be difficult to prove, states will look at a variety of factors when determining domicile: the property you own, where you are registered to vote, any licenses (such as a driver’s license), and any financial accounts held in the state.

Verify your state’s residency requirements. Although being “domiciled” in a state is usually sufficient for proving “residency,” it is not necessary. You may also be considered a “resident” of a state even if you are not domiciled there. State residency requirements may be found at the state’s Department or Division of Taxation. Each state may have different requirements. For instance, in California, you are deemed a “resident” if you (1) are domiciled in the state or (2) are not in the state for a “temporary” purpose. If you work in California for 9 months or more in a year, you are presumed a resident. New Jersey is a state that has complicated rules. For example, you are defined as a “non-resident” if New Jersey was not your domicile and you spent 183 or fewer days in the state; if New Jersey was not your domicile and you spent more than 183 days in the state but did not maintain a “permanent” home there; or if you maintain no “permanent” home in any state at all and spent 30 or fewer days in the state. As another example, Minnesota considers you a resident if you spent at least 183 days in the state (with any portion of the day counted as a full day) and you or your spouse owned, rented, or occupied a residence in the state with its own bathing and cooking facilities. People can own property in a number of states. Owning property doesn’t necessarily make you a resident of that state, though it may be a factor in determining your permanent presence in a state.

Check to see that you were a resident for the entire year. If you moved your home from one state to another during the year, then you are usually considered a “part-year” (PY) resident of both states for tax purposes. In this case, you will file a PY return in both states. Any tax exemptions will be pro-rated. States pro-rate differently. Some will adjust the amount depending on the time resident in the state. Others will pro-rate depending on what percentage of your gross income you earned in the state. Different states can have slightly different rules about PY status, so check with your state's tax authority if you have any doubts about whether or not you are a PY resident. PY status generally applies to people who move at any point during the tax year — even, for instance, one day before the end of the period.

Determine your residency status if you’re in the military. Military personnel are often stationed in states other than their home state. The state where you enlisted (not where you’re stationed) counts as your home state until you decide to move to another state permanently.

Understanding Tax Requirements for Your State

Identify sources of income. Go through your income reports (W-2, 1098, 1099, etc.) and identify the state in which you earned the money. Make a list. However, it may be difficult to determine in which state you earned money for incomes such as dividends from stock investments. Typically, you can allocate this type of income to the state in which you lived when then income was received. When filing taxes for your resident state, you will report income earned in both your resident state and any other state. When filing for a non-resident state, you will report only what you earned in the non-resident state. If you live in one state and work remotely in another state, you may only need to file your resident state tax return. But if your W-2 form for your remote job lists another state, then you need to file a non-resident state tax return for this state. In this case, you also need to file your resident state tax return. Another factor that may determine your filing status is the “source rule.” This refers to the physical place where work is completed. If you physically come to another state to complete work, you must file a non-resident tax return. If the work is physically completed in your resident state (you are working at your home, for example), then you may not have to file a non-resident state tax return.

Calculate if you earned enough to pay taxes. You generally will not file taxes in states where you didn't earn enough to pay taxes. Most states (and the federal government) will only tax income above a certain amount. If you make less than this amount, you won't have to pay any income taxes. However, you may still want to file a return in that state in order to get a refund of any state taxes that were withheld. The exact cut-off point varies from state to state, so check with your state tax authority to find out. For example, part-year and non-residents in Wisconsin are only taxed on income above $2,000. If you made $1,800 in Wisconsin, you would not need to report it. However, you will need to report this income in your resident state. You don’t have to worry about filing taxes for states that don’t have an income tax. Currently, Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming do not tax income. Two other states—New Hampshire and Tennessee—tax only income from interest and dividends. If you earned money in one of these states, you do not need to file taxes in that state. If you worked in one of these states but are resident in a state that does have an income tax, you must report your out-of-state income in your taxes for your resident state.

Check which states have withheld taxes. Some states have tax reciprocity agreements that allow non-resident workers to request income withholding from out-of-state earnings. These agreements are usually made with neighboring states that share many employees. For example, there is a reciprocal agreement between Maryland and Washington, D.C. There is also one between New Jersey and Pennsylvania. You may have had taxes withheld from your out-of-state earnings already if you filled out the necessary forms.

Filing Separately or Jointly as a Couple

Determine if you plan to file separately or jointly. Married couples in the U.S. are allowed to file one tax return as a couple (this is called filing jointly) or to file their own tax returns separately. Generally, most couples get the biggest benefit from filing jointly. But there are certain situations where couples may want to file separately. Note that in some cases, you may be required to file your state taxes using the same filing status (jointly or separately) that you used to file your federal taxes. If one spouse earns most of the income, then the couple could benefit from filing jointly. By contrast, if each spouse earns about the same, then they might want to file separately.

File a part-year form if one person moved during the year. If you are filing jointly and one person was a part-year resident of two states, you will need to file using a part-year form in both states.

Report non-resident income when filing jointly. If you are filing jointly and one person earned non-resident income in a state outside your resident state, you will need to report this on your resident state income tax form. This applies if your state has an income tax. You may also need to report this income as non-resident income in the state where you earned the money. This is likely the case if the state has an income tax.

Use your own resident status if you file separately. If you and your spouse are filing separately, each person should use the resident/non-resident/PY status that applies to him or her. Your spouse’s resident status does not affect your own status.

Filing Your Taxes

Calculate your federal adjusted gross income. You will usually want to complete your federal income tax return before doing your state returns. This way, you can accurately report your federal adjusted gross income on your state returns. Generally, it's best to prepare your federal income taxes before your state taxes. If you itemize deductions, you can deduct the state income tax from your federal taxes. However, note that any payments you make for state income taxes will only be deducted for the year in which you paid them. For instance, if you pay state income tax in 2019 for the year 2018, you can deduct that amount from your 2019 taxes.

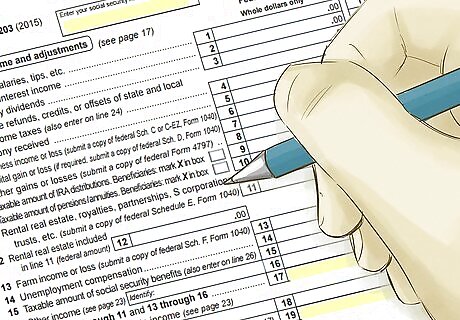

Find the tax return forms for your states. Each state will have its own specific tax return forms for you to use. Use the Revenue Department websites for both states to find the appropriate forms. If you must file as a non-resident or part-year resident, find the appropriate form. States often require that these taxpayers use forms that are different than those used by residents. Although two states' forms may be very similar to one another, you must use the proper form for each state.

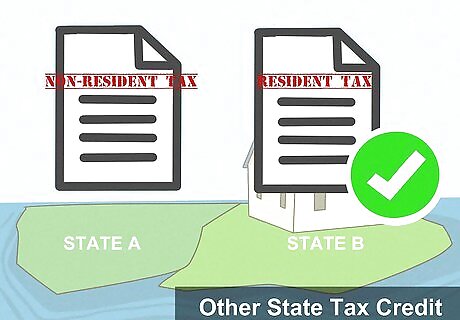

Take out your resident income tax form. Report the income you earned in your resident state. Also report non-resident income on your resident tax form. If you are a resident of one state and earned non-resident income in another, you usually need to report this income on your resident state tax return. You are required to pay tax on all income received, even if it is from other states. But you will likely be eligible to receive a credit on your resident state taxes. This will be calculated according to how much you already paid in the other state.

Report non-resident income on the non-resident tax form. When you earn non-resident income outside of your home state, you report only the money you made as a non-resident on your non-resident tax form.

Take a credit for non-resident income on your resident tax form. To avoid having your out-of-state earnings taxed twice, you are usually allowed to claim a "credit" for them on the "Other State Tax Credit" portion of your resident tax form. This will typically be a dollar-for-dollar exemption. To claim this credit, you will probably need to select and fill out the long form version of most states' tax forms (as opposed to the short form version).

Report income made in each state on part-year forms. If you are filing as a PY resident in two states, report your total federal adjusted gross income. You will also need to report only the amount of income that you made in the state. For example, if you lived in California for the first part of the tax year and moved to Wisconsin for the second part of the tax year, you would need the PY tax forms for each state. In most states, you will receive a prorated percentage of your itemized or standard deduction according to the percentage of your taxable income that was made in the state. In other words, if you work for the majority of the year in one state and a small part of the year in another, you will get a bigger percentage of the deduction for the state you spent more of your time in.

Complete and file federal and state tax returns. Make sure you have completely filled out and submitted all of your tax returns by the due date. You can submit tax returns either by mail or over the internet via e-filing. Regardless of the method you choose, fill out the appropriate tax forms for both states and submit them by the states' filing due dates, along with any supporting documents and balances owed. Visit the IRS E-File website for a list of every state's filing due date. Most are in mid-April, but there are some exceptions.

Comments

0 comment