views

Estimating Allowance for Doubtful Accounts

Gather accounts receivable documents. When selling goods or services on credit, it is unlikely that a company will be able to collect all of the money owed; some customers will default. To account for this, begin with your business's current and historical accounts receivable records. These should detail the business's various customers and their order amounts, along with whether or not those customers have paid for their orders in the past.

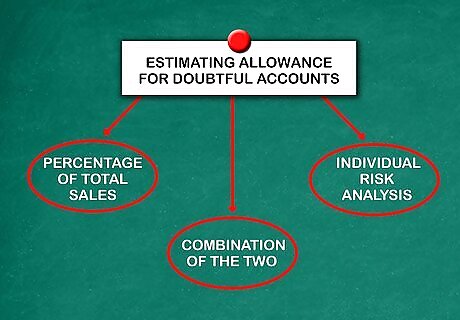

Determine which estimation method to use. Because the allowance for doubtful accounts is calculated for potential future payments, it is not a direct expense measure, but an estimate of expected future defaults. This means that unlike your power bill or the cost of printer paper, you will not know what your actual doubtful debt expense will be. This is because when you report your expenses, you will have recorded all customer orders as revenues, regardless of if they have been paid or not. Therefore, reporting requires you to estimate the total amount of sales orders will not be paid. There are several different ways to go about estimating this expense, including: Using a percentage of total sales, Using individual risk analysis, or Using a combination of the two. Which one is the best choice for your business depends on the makeup of your customer base. The ideal consumer base and estimation process for each method are explained in the following steps.

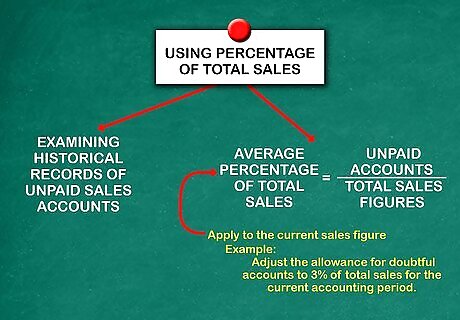

Use a percentage of total sales. For companies with a relatively large number of smaller accounts (customers that only buy small amounts of product), or companies that historically have experienced only a very small amount of unpaid accounts, the best and easiest option is to estimate the allowance as a percentage of sales. Calculate a reasonable percentage of sales by: Examining historical records of unpaid sales accounts. Look over your records and find out when sales accounts went unpaid. It's generally a good idea to look over the past five years and find out your total sales for each year and the total value of unpaid accounts for each year. Finding the average percentage of total sales that this debt accounted for. For each year, divide the value of unpaid accounts by your total sales figures. This will give you a percentage of total sales that went unpaid. Applying that percentage to the current sales figure. For example, if 3% of debts historically went unpaid, the company will adjust the allowance for doubtful accounts to 3% of total sales for the current accounting period.

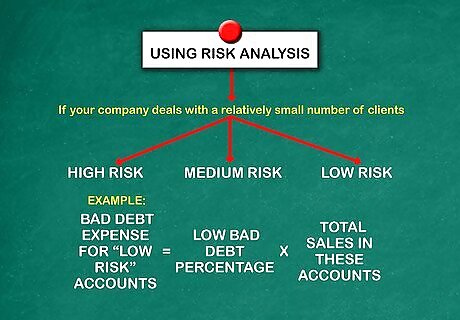

Use risk analysis. If your company deals with a relatively small number of clients, use an individualized risk analysis for each customer. This requires organizing clients into categories based on historical risk of unpaid accounts. For example, some clients might be deemed high risk, while others might be low risk or medium risk. Each category is then assigned a doubtful accounts percentage that reflects the likeliness of customers in that category failing to pay their accounts. Multiply these percentages by total sales in each customer category to arrive at an estimated allowance for doubtful accounts. This method can be more art than science. For example, you cannot assign a historical risk rate to a new customer. In this case, you can use either a historical percentage of sales for all accounts (see previous step) or you can use your own personal judgement of the customer. Additionally, a customer that has historically let their purchases go unpaid may become more reliable with time or improving business. This might be reason enough to raise their risk rating higher than a historical analysis would suggest. For a more specific example, imagine a customer that has historically paid their debts every time or almost every time, perhaps only faltering once during hard times.Classify sales by this customer, and others like them, as "low risk" and assign them a very low bad debt percentage like 0.5%. Then, multiply this bad debt percentage by total sales in these accounts to get the bad debt expense for "low risk" accounts.

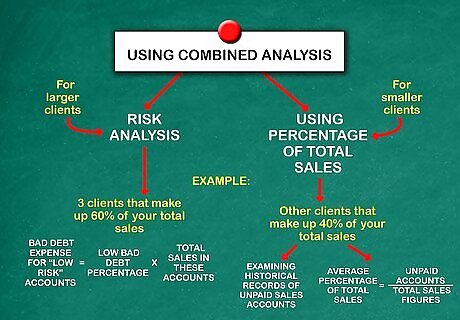

Use a combined analysis. If your company has a large amount of clients, but also a few large clients that make up a disproportionate share of total sales, consider combining the two above methods. Specifically, use the risk analysis method for the larger clients and the percentage of sales method for the smaller clients. This requires separating total sales for large clients from total sales for smaller clients, but is more accurate than simply using a historical sales percentage across the board. Imagine for example that you have three clients that, combined, make up 60% of your total sales. All of these clients are in good standing and almost always pay for your products on time. Assign these clients a low bad debt allowance percentage, like 0.5%, and multiply this number by total sales to these customers to get an estimate bad debt expense. The other 40% of your business is made up of smaller customers that only order a few products at a time. For these customers, you would examine total unpaid debts and total sales to these customers to create a historical unpaid debt percentage to use for these customers, maybe at 4% or so.

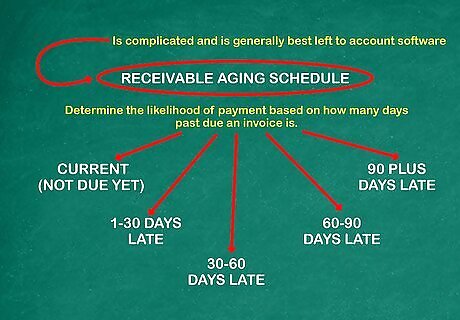

Create a receivables aging schedule. This additional option is for all types of customer bases, and is a more complex process that uses historical data to determine the likelihood of payment based on how many days past due an invoice is. Essentially, decide on an average point at which very late accounts typically become uncollectible accounts and estimate your doubtful accounts by age. This schedule categorizes accounts as either current (not due yet), 1-30 days late, 30-60 days late, 60-90 days late, or 90 plus days late. Figuring out bad debt percentages using this process is complicated and is generally best left to account software, which can calculate this information accurately and quickly.

Accounting for Doubtful Accounts

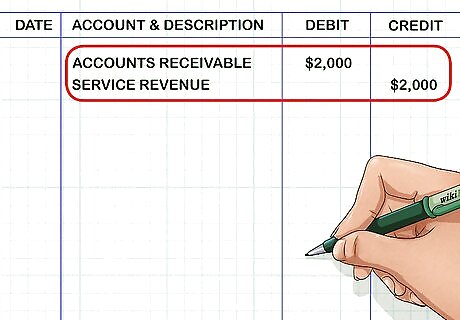

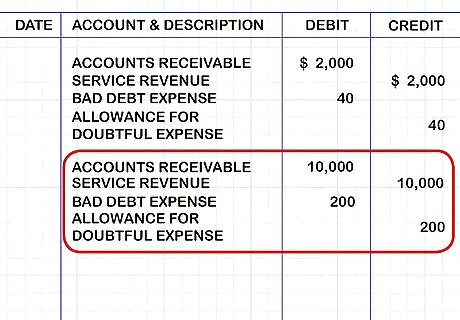

Record the journal entry to recognize a sale on credit. Accounting for doubtful debts presupposes credit sales, so begin by recording the sale in the general journal. For example, imagine that your company sells $2000 of services to a customer on credit. To record the journal entry, you will debit Accounts Receivable for $2000 and credit Service Revenue for $2000.

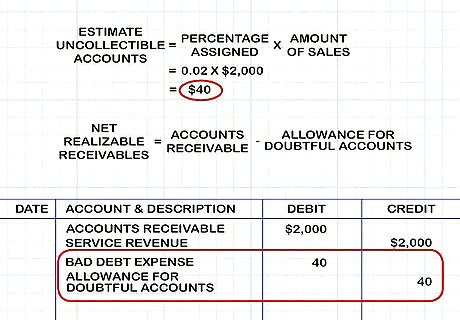

Record the journal entry to create the doubtful account allowance. In the example above, assume your company decides to estimate uncollectible accounts as 2 percent of total service revenue. The allowance needed is therefore (0.02 * 2000), or $40. To record the journal entry and establish the allowance account, debit Bad Debts Expense for $40 and credit Allowance for Doubtful Accounts for $40. Subtract your allowance for doubtful accounts from Accounts Receivable to reach at what is called "net realizable receivables." This is your total amount of receivables that you expect to actually collect. Record the expense in accordance with the matching principle. Even though this customer may very well pay in full, record the expense to match it with its corresponding revenue.

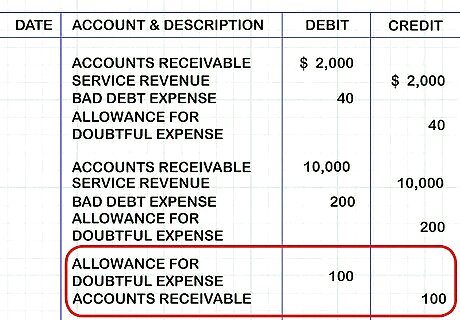

Adjust the balance of the allowance account as necessary. If the company above records another $10,000 in service sales, make another journal entry to increase the allowance account. Debit Bad Debts Expense for $200 and credit Allowance for Doubtful Accounts for $200. The allowance account's balance is now $240. If you are using any form of risk categorization, remember to adjust the additional revenue doubtful account percentage based on which customer or risk category it is coming from.

Record the journal entry to recognize an uncollectible account. When an individual account is identified as uncollectible (for example, if the buyer went bankrupt and lost all their assets), a journal entry is needed. In the example above, imagine that a customer's account balance of $100 has been deemed uncollectible. To write off the account, debit Allowance for Doubtful Accounts for $100 and credit Accounts Receivable for $100. In this way, the allowance account balance is used to essentially cover the drop in receivables.

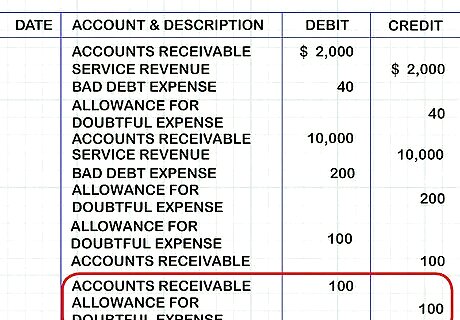

Reverse the entry upon payment. Sometimes, a payment recorded as uncollectible may eventually be paid in full or in part. This is generally due to action taken by a collections agency. In this case, reverse the entry by debiting the amount of the payment recovered to accounts receivable and crediting the allowance for doubtful accounts for the same amount.

Comments

0 comment