views

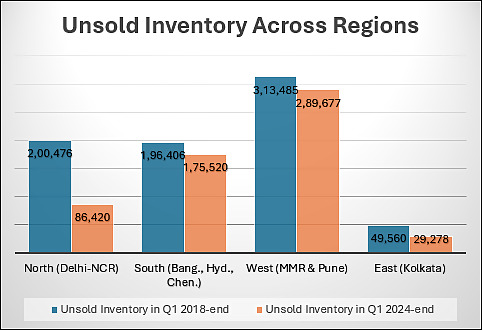

Going by a region’s prevailing unsold housing inventory as an indicator of its realty market’s health, north India’s Delhi-NCR – once notorious for speculation-driven oversupply and all-round market disarray – is in significantly better shape than the other regions. The latest Anarock data indicated that Delhi-NCR’s unsold inventory declined by a massive 57% in the last five years.

The top southern markets Bengaluru, Hyderabad, and Chennai saw their collective unsold stock shrink by 11% in this period.

MMR and Pune in the west saw their cumulative unsold stock reduce by 8%. In the east, Kolkata saw its unsold inventory decline by an impressive 41% in the period.

NCR’s unsold stock declined from approx. 2 lakh units at Q1 2018-end to approx. 86,420 units by Q1 2024-end. In the same period, the main southern cities saw their unsold stock decline from over approx. 1.96 lakh units in Q1 2018 to over 1.76 lakh units in Q1 2024.

South India’s relatively low decline in unsold inventory is attributable to a massive new launch rate in Hyderabad, most notably over the last two years. The city saw its housing stock almost quadrupled in the last 5 years. Bengaluru saw unsold inventory decline by 50% in this period.

In the west, MMR and Pune saw unsold stock decline by 8% in the last five years – from approx. 3.13 lakh units in Q1 2018 to approx. 2.90 lakh units in Q1 2024.

Santhosh Kumar, vice chairman, Anarock Group, said, “What really worked for the NCR market was developers’ determination to keep new supply additions under control. Anarock data indicated that NCR witnessed a total new supply of approx. 1.81 lakh units between Q1 2018 to Q1 2024. In contrast, the southern and western markets saw significantly higher new supply additions of approx. 6.07 lakh units and 8.42 lakh units respectively.”

“NCR’s upbeat performance also reflects renewed buyer confidence in the region,” added Kumar.

“RERA, GST and the intervention of AIFs like the SWAMIH fund have played a major role in this sentiment revival. As a result, more leading and listed players have increased supply in the region.”

Of the total unsold inventory in NCR:

- Gurugram currently has the maximum stock of approx. 33,326 units – a 37% decrease in the last five years.

- Greater Noida is next with approx. 18,668 units lying unsold as of Q1 2024-end. However, Greater Noida reduced its stock by a whopping 70% since Q1 2018.

- Ghaziabad saw its unsold stock decline to approx. 11,011 units in Q1 2024, from approx. 37,005 units in Q1 2018 – a massive 70% 5-year decline.

- Noida had approx. 7,451 unsold units by Q1 2024-end, against 25,669 units in the same quarter of 2018 – thus declining by 71%.

- Delhi, Faridabad & Bhiwadi together had approx. 15,964 unsold units as on Q1 2024-end, from approx. 23,038 units at Q1 2018-end – a 31% decrease.

Comments

0 comment