views

State Bank of India (SBI), India’s largest lender, has raised its marginal cost of funds-based lending rate (MCLR) by 10 basis points. The revised rates are effective from August 14, 2024.

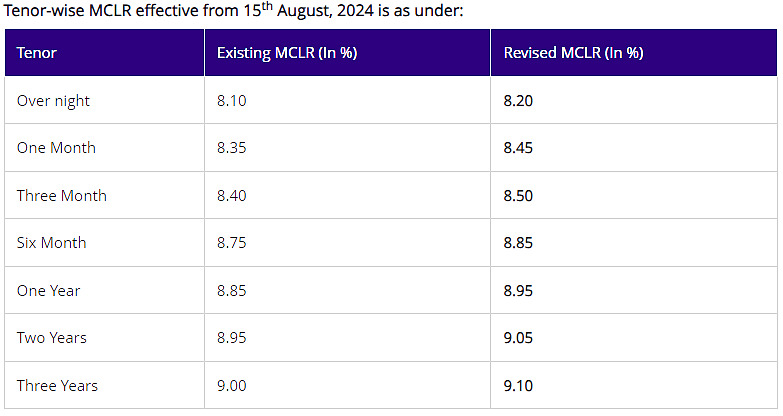

SBI Revised MCLR Rates

SBI’s overnight MCLR has increased from 8.10% to 8.20%. The monthly MCLR has risen from 8.35% to 8.45%, and the 3-month MCLR has also gone up by 10 basis points, from 8.40% to 8.50%.

The changes in MCLR rates are as follows:

Impact On Loans

The interest rates on loans are also likely to rise by a similar measure, and EMIs rise on linked loans.

MCLR is a crucial factor in determining the cost of borrowing for individuals and businesses in India.

MCLR is essentially the minimum interest rate a bank can charge on a loan. This rate is determined by considering the bank’s cost of funds, operating costs, and a certain profit margin.

In July, SBI had raised its MCLR by 5-10 basis points.

Recently, state-owned PNB raised the MCLR by 0.05%, or 5 basis points, across tenors, making most of the consumer loans costlier.

The benchmark one-year tenor MCLR is at 8.90% against the earlier rate of 8.85%, PNB had said in a regulatory filing.

The three-year MCLR stands at 9.20%.

Among others, the rate of one-month, three-month and six-month tenors is in the range of 8.35-8.55%.

The MCLR on overnight tenor is 8.30%.

The new PNB rates were effective from August 1, 2024.

Comments

0 comment